Listing inventory keeps rising in SW Florida. Both single family homes and condo inventory have been rising steadily since February 2022.

Listing Inventory Keeps Rising in SW Florida

It’s simple math. More homes are coming on the market than going off. Supply is outpacing demand. When you sit down and really think about it, it hits you. When you read the headlines, you would think the real estate market is on fire and everything is rosy. By and large, we have a good real estate market.

Many sellers get it. Some came out with aggressive pricing to test the market, almost not believing that the market has changed from what it once was. Then reality sets in. This past week alone 428 single family homes reduced their price. Of the 428 price reductions, 17 went pending.

Wouldn’t it be better to set a price where you know the home will sell? You don’t have to price it below the market to do this. Pricing above the market ensures the property will sit, and when it does buyers begin to wonder why other buyers have rejected it. Overpricing a home can cost you. If listing inventory keeps rising you would want to get ahead of that.

New Pricing Method

The problem with looking at comparable home sales is everything is in the past. Sold pricing doesn’t always give you an accurate picture of what is going on in the market today. Sure, appraisers can issue a time value adjustment when they see a changing market, but that doesn’t help home sellers as that is always calculated after the fact.

How should home sellers look at pricing their home for today’s market? There is a new market methodology that better identifies where a home should be priced. The advantage to getting the price correct upfront is you end up with a better price on the back end.

Have you ever watched a neighbor’s home go on the market? One that you know is overpriced. Back in 2021, that overpriced listing might have sold. But this isn’t 2021 anymore. Today that listing sits, and sits, collecting dust and cobwebs because nobody wants it at that price. Your neighbor needs to sell, they just haven’t come to the realization yet that they aren’t going to get their price. They feel like they need a certain price to not lose money. Possibly they need a certain amount for their next venture.

Market is Option Based

In the end, the market doesn’t care what your neighbor needs. The market only cares about what the home is worth, and how it compares to other alternatives. Buyers today are hit with higher interest rates, higher insurance costs, and higher cost of living. Their money is stretched thin, and they for darned sure don’t want to overpay for a home in today’s economy. Buyers will select their best option.

I don’t want to say buyers are adversarial towards sellers. They just don’t care about the seller’s problems because they have their own. Remember a few short years ago. Sellers didn’t care about the buyer’s circumstances or how they might become homeless a few years ago. Buyers today do not care how much a seller needs from their home sale.

This is how it should be. Buyers and sellers should focus on what the home is worth today, not what it used to be worth, or why this deal should be different than the market.

When you focus on the data, you tend to get a better outcome. The data will win the day anyway, unless the home sits on the market getting tired and worn in the buyer’s eyes. In this case, the home might eventually sell for less than it should.

Aggressive Marketing

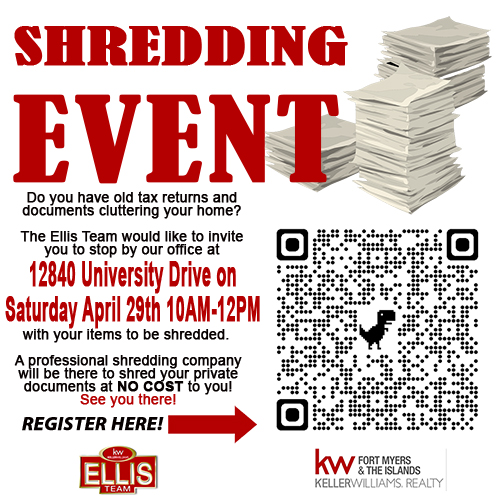

Thinking of selling? You need a Realtor with aggressive marketing, and one with experience in a changing market. The market is still good, but for the best results use an experienced pro who’s been there before. This is why the Ellis Team at Keller Williams has been voted Best in Real Estate by News Press Readers for 10 straight years. Put our knowledge and marketing to work for you! 239-310-6500

Good luck, and Happy Home Selling!