Recent sales numbers suggest local home sale prices under pressure from rising interest rates. Nationally we are seeing price resistance due to rising rates, so we decided to study the local market to see what is happening here.

From the graph we can see both median and average home sale prices topped out around April to May. We must be careful here because there is seasonality to the market, and it is not uncommon to see this in normal years.

Preliminary July numbers show a median sales price in Lee County of $425,000 and an average sales price of $552,596. Keep in mind these numbers were pulled July 26th and do not incorporate a whole month. It does give us an indication though of what we have seen the first 26 days of the month. In June 2022 the media sales price was $449,950 and the average was $587,904.

Home Sale Prices Under Pressure

If these numbers hold up, that’s a big drop from June’s numbers. If true, this would support the cause that rising interest rates may have influenced home sale prices locally as well.

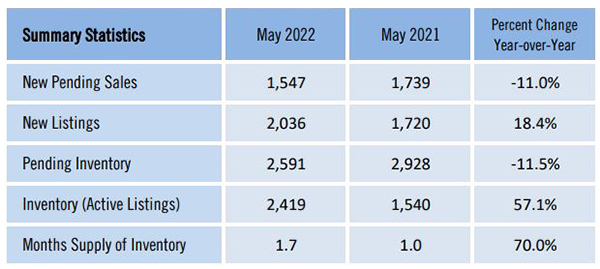

This makes sense because we have seen single family home inventory triple since Feb 15th. This tells us supply is outpacing demand. Home prices are fabulous compared to what they were a few years ago if you are a seller, but they may not be what they were back in February.

Pricing for sellers will be critical with home sale prices under pressure from rising interest rates. We are writing this article before the Fed announces its interest rate decision and GDP numbers. If GDP numbers come out negative for the second quarter, we can safely say the US is in a recession.

We are already seeing layoffs at companies nationwide. We are particularly concerned with potential layoffs in 2023 as that is when we believe the pain of rising interest rates will be most felt. It is possible that the Fed will raise rates 75 to 100 basis points this week and mortgage rates could drop. If they do it is because the markets are anticipating recession into 2023.

Opportunity for Buyers Right Now

We believe there is a window for home buyers to lock in lower rates. Nobody knows what long term rates a few months from now will be, but mortgage rates have crept down in recent weeks. Mortgage rates are based of the 10-year note, and the 10-year note is lower than the 2-year note. This is what is referred to as an inverted yield curve, and this too is an indicator of a coming recession. Again, we may already be in one now. The question is, what will 2023 bring and how severe could it be?

The good news for buyers is rates have come down and selection of homes on the market has risen. Prices have come down too, and in the coming weeks we can report official numbers to verify what we are seeing.

If you have a property to sell, Always Call the Ellis Team at Keller Williams Realty. 239-310-6500 Marketing and proper pricing right now are key, and many Realtors have only been in the business a few years and do not have the experience in a market like this. Brett and Sande have been through many real estate cycles, so no matter what the future brings us, we know how to handle it.

If you’d like to track your home’s value over time, check out www.SWFLHomevalues.com It’s a neat website that will email you your home’s value each month.

Let’s Talk

We are here to talk. Many times, buyers and sellers have questions, and you need a Realtor with answers based on knowledge, statistics, and experience. This is not the time to hire a newer agent.

Call the name you know, the Ellis Team at Keller Williams Realty. Good luck, and Happy House Hunting!