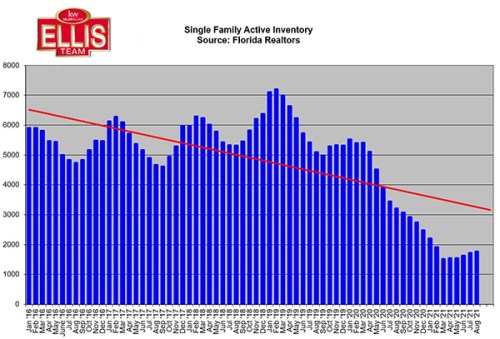

Lee County listing inventory increased fifth straight month which has led to a leveling off in home prices. We are seeing September daily listing inventory counts drop slightly so we will keep an eye on official numbers when they are released next month.

As you can see by the chart, listing inventory is still very low comparatively speaking. We look at actual numbers and the trends. The actual numbers tell us where we are at a point in time, and trends can give clues about the future. Once a trend emerges it does not mean it will stay, so we must be careful predicting the future based upon a small trend in data.

Median home prices peaked in May and June and slipped a bit in July, however they held steady in August. Average home prices peaked in April and slipped in May, June, and July. Average home prices rose slightly in August, confirming the trend that home prices have leveled for now.

Seller’s Market

With 1.1 months of official inventory, we are in a seller’s market. August saw a rise in new listings of 3.6% and a drop in new pending sales of 10.2%. The daily inventory numbers are telling as well, and we may see the SW Florida real estate market pick back up again. Rentals are very expensive, and in many cases, it is cheaper for a buyer to purchase than rent.

The number of homes closed fell again for the second straight month. Nationally mortgage applications are picking up again. With Covid cases decreasing dramatically in Florida and the return of Fall, we may see the market heat up once again.

What is unknown is when and how fast interest rates will climb. The expectation is the Fed will taper asset purchases which have helped keep rates low. We expect the Fed to announce the start of tapering in November which means rates could rise by the end of the year.

Increased borrowing costs will cut into buyers purchasing power. Eventually decreased purchasing power helps cap price increases. The fascinating thing to watch is that the US has been short building units to the tune of 5 million plus. This has caused a shortage in supply. Housing demand is strong. These two forces are at odds with each other, and whichever wins out will hold the key to the direction in home prices.

It is quite possible they will temper each other. If this happens, we will return to normal price swings and a leveling off, which is a good thing.

Time for Seller’s to Sell

The takeaway for sellers is now may be the time to sell. The takeaway for buyers is now may be the time to buy. If you are a seller looking to purchase a home with a mortgage, this is especially true for you.

You might ask, how can it be a good time for buyers and sellers to make a move? The answer is, it may cost both groups to wait. Most people think of buyers and sellers as dueling warriors, and one must win to the other’s detriment. The reality is, in this market, both can win now, and both can lose in the future by waiting.

We live in interesting times. So many factors are affecting our economy, from supply side shortages, to rising rates, to rising inflation. The Delta variant changed things for Floridians for a few months. Assuming no new major variants, between the vaccinated and those with natural immunity, Florida is shaping up to be in good shape going forward. This Fall and Winter will be interesting to watch.

Always Call Brett or Sande with your real estate questions 239-310-6500 or visit www.SWFLHomevalues.com to get an instant value on your home.

The Ellis Team at Keller Williams Realty is here to help you with your questions. Good luck, and Happy House Hunting!

Ellis Team Weekend Open Houses

Open House Saturday and Sunday 12-3 PM

1936 Savona Parkway, Cape Coral