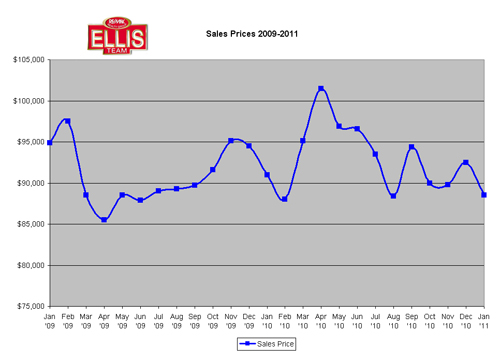

The Florida Association of Realtors released official numbers, and as expected the number of sales were down, but fairly steady with last year. We predicted in last week’s article they’d be right where they are. We also said last week that we didn’t study the sales prices, but that we wouldn’t be surprised if we saw them rise again in January. Perhaps we should have studied those numbers because they did not rise, they actually fell 3.86% from last year’s numbers and fell 4.32% from December’s numbers.

We can’t put too much emphasis on one month’s numbers, especially January numbers because there was a flurry of activity in December to get homes closed by the end of the year. Many sales have stalled or pulled due to title issues. We’re just now getting a few listings back from the banks in the higher priced end that were stalled due to this, so this can have an impact on closings and prices temporarily.

Just the same, we half expected prices to rise again as we believed fewer sales would equate to rising prices. Because more of the foreclosure sales in the past have been in the lower price points, fewer foreclosure sales means the median sales prices gets pulled up from the top and pushed up from the bottom. This evidently did not occur. It is possible that as more short sales went through they were in the lower price points.

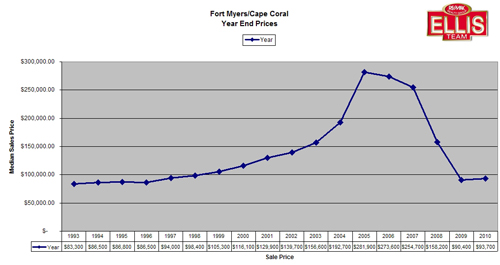

It is season now and we have pent-up sales and rising pending sales, so again going forward we will not be surprised to see rising prices. In fact last year this happened as evidenced by the chart.

This past week we attended the News Press Market Watch National Association of Realtors Chief Economist Lawrence Yun gave some insightful statistics that may impact the US and SW Florida markets. He expects interest rates to hit 6% by the end of the year and 6.5% sometime in 2012 as rising deficits lead to inflation.

Mr Yun still believes we will see 50-60% distressed sales in the SW Florida real estate market this year, and we have 2-3 years total before all foreclosures are worked out of the system. If President Obama enacted an elimination of the mortgage interest deduction it would have an immediate effect of lowering prices nationwide by 15%, and our economy doesn’t need another big hit from real estate.

He expects about 3% GDP growth and unemployment to be around 9% in 2011 returning to a normal 6% by 2015. Businesses are making money, but they’re afraid to hire due to uncertainties with new health care costs and banks aren’t willing to lend to businesses due to blank pages written into new banking rules. By blank pages he referred to pages that state a future committee will determine actual rules, so banks are hoarding cash and not lending.

Mr Yun says Washington DC is to blame for businesses not hiring due to uncertainty. If we could give certainty back, business may hire more quickly, and this would speed up time lines for recovery dramatically. For instance, we’ve lost 8 million jobs since Obama took office, and in 2010 we created 1 million jobs. 1 million jobs is pretty good, but nothing compared to what we lost. At this rate we’ll create 2 million jobs in next 2 years, but we’re still way down from levels just 2 years ago. If we could speed up businesses hiring, we could speed up the recovery, which would help real estate. Wall Street is doing OK as we’re seeing record profits, but no motivation to hire due to Washington.

Sales are near record levels. To put this in perspective, in 2001 we had 376 single family home sales. We had 443 in 2002. In 2011 we had 1,072, down slightly from 1,115 in 2010. Our sales are on fire. Our prices leave a little bit to be desired, unless you’re the buyer. Buyers realize SW Florida is on sale and they’re buying as fast as they can. We can see light at the end of the tunnel, and prices should increase going forward. Just don’t expect 2005 pricing to come roaring back anytime soon. We’re looking for modest gains, and as Dr. Yun says, cities like Las Vegas and Fort Myers might even see some occasional surprises on the upside of pricing going forward.