For months we’ve been telling sellers it may cost them to wait when selling their home. This is true for a variety of reasons, but the two most important are when you sell, chances are the home you’ll purchase to replace your current home is also increasing in value, and because rising rates affects your buyer and your next loan too if you’re getting one.

That’s not the purpose of this article though. While sellers wait for the absolute highest prices on their home, they should keep in mind that prices won’t rise 12% per year forever. We’re predicting another good season. Inventory is low, rates are still pretty low, and demand is high. However, demand begins to fall off at certain prices. So we ask the question, has a seller slowdown begun in SW Florida? Let’s take a deeper look.

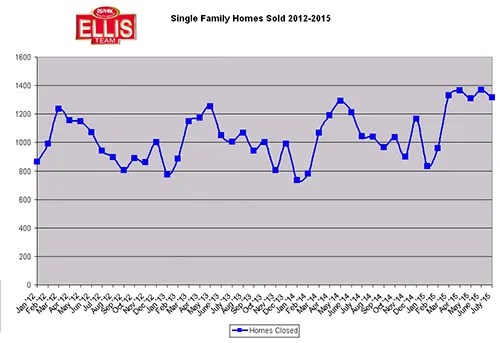

If you look at the graphs, you’ll notice that typically home prices peek around April each year and again in June. Many times June is even better than April. This year, we saw the peak in April but didn’t see the 2nd peak in June.

Furthermore, homes closed in SW Florida usually peaks around May, and then we see some strength in July-August, albeit not quite at May levels. This year August numbers fell off. This could be due to lower inventory levels, but it could also be the start of a trend.

We’re cautious not to read too much into any one month period, and moving forward this will be especially true as new Federal lending and closing guidelines will extend financed closings out longer.

Cash sales in August for single family homes were 37.4%. This was a 20% decline from the previous year. This is good news as financing has helped push prices higher. We always said this market will not be fully healed until financing and capital comes back into the market. We have that now, but with that come appraisal issues and closing delays.

We think we’ve got an excellent market. Buyers are shopping though and are price sensitive. Even with low inventory, if a property is over-priced buyers are sitting on the sidelines.

October begins the start of Season. Last year we saw an uptick in buyer activity in October. It used to be said Season was January-April but it’s started earlier. We think we’ll have another great season, but sellers may not want to wait much longer. The graphs may be a sign of things to watch, or they could just be a temporary blip.

Some economists are talking about recession starting in 2018 while others are talking about the end of 2016.. Nobody can predict accurately when a market will bottom or when it will top, but looking back there are generally signs that foretold the future and they were ignored. People tend to follow the herd and ignore signs because when it’s all good, they want to believe. And when a market is near bottom, nobody wants to believe it’s over until they see proof. Thus, people usually miss the top and the bottom because they wait until they see the change on paper. For this reason, most people will absolutely miss the top and the bottom unless they just get plain lucky.

Bottom line is we’ve got a great market. Just don’t get too greedy and over-price your home. Over-priced homes sit in any market, and you don’t want to look back and say I missed another boom market like 2006 simply because I got greedy again.

If you’d like to search the MLS, you can do so. If you’re thinking of selling, it pays to talk to the Ellis Team at RE/MAX Realty Group. Our sellers net about $10,000 more than the average seller. Call us and find out why. 239-489-4042

Good luck and happy house hunting!

Featured Property of the week! 102 Maple Ave S in Lehigh Acres FL

Check out all the Ellis Team Featured Listings