A recent survey by Realtor.com revealed there are more sellers ready to list their home in 2022 than 2021. Many sellers were waiting out the pandemic.

Of the sellers ready to make a move in 2022, 65% plan to do so in the next 6 months. Sellers have noticed price gains have slowed which may be prompting the timing in the next 6 months. More than 1/3 have already researched the value of their home. One of the best places to research the value of your home online is www.SWFLhomevalues.com. It is not a substitute for an experienced real estate agent or appraisal, but it is one of the best places to start online for Free.

Many Sellers Want Different Features

Many sellers spent more time in the home due to Covid. Last spring, 15% wanted different features in their home. Now that they’ve spent more time in their home, that number has increased to 33%.

Of the sellers planning to list, 42% plan to list for more than they think property is worth. 29% will want a quick closing, so future sellers will have different motivations. Ultimately the market will determine the value, but the seller will set the price.

This was a national survey, and we all know real estate is local. While this may be an indication of how sellers are feeling, what happens in SW Florida may be different.

Best Time Ever to Sell?

We believe now is the best time it has ever been to be a seller. Technically 3 months ago might have been better, but some prices have still drifted upward, and sellers today are no worse off by waiting. 3 to 4 months ago we had more offers per listing, and that drove the price up. You don’t need 25 offers per property today because the price has already been driven up and is not falling. The bidding wars in the past did the dirty work for sellers. Sellers just need enough buyers to maintain what was achieved months ago, and so far, that is the case.

Increasing Demand

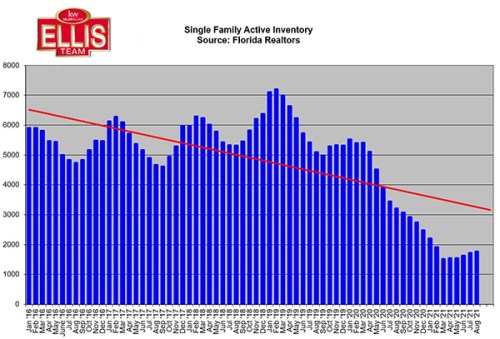

Going forward, we see increasing demand. This increased demand may outpace increased supply from sellers which could further drive our market. Many businesses have made the decision to relocate to Florida. Some of these decisions were made in the last few years, and some are being made today. These relocations take time and do not happen overnight. Someday the rest of the country’s real estate market could cool down while Florida remains hot.

We are astounded at how many buyers are coming in from other states. These are not retirement buyers; they are buyers moving here permanently and working here. They are moving their family here and deciding Florida is not only a nice place to work but also a nice place to live.

Registrations on www.LeeCountyOnline.com have increased. These are people looking for homes. Some are here renting or living with relatives and others are flying here to buy a home to relocate. Having one of the most popular real estate websites in SW Florida allows us to see buyer activity in real-time and witness trends. These national surveys are interesting, and we love to report on them, but they just confirm what we are seeing online.

Sellers Ready to List Their Home

If you own a property in SW Florida and want to know the latest trends in the market, schedule a call with Brett or Sande Ellis at 239-310-6500 We can discuss what we are seeing and how this affects you and your home value.

If you are a buyer, call our home buyer hotline at 239-489-4042 to be connected with a buyer specialist who can help you purchase a property. Our agents are experienced, and experience counts. Unfortunately, we see buyers losing out to other buyers because the agent representing them didn’t have the experience to counsel their buyer on what it takes to write a winning offer. It is not always the highest price offer that wins. Relationships matter too. The Realtor you hire matters now more than ever.

We are here to answer your real estate questions. Good luck, and Happy Selling!