Home sellers typically want top dollar for their home sale but it’s hard to tell which agents deliver top dollar for their clients. Real estate sales have evolved, but not all real estate agents have kept up with new technology and buyer preferences. Wouldn’t it be nice if there was a list of top dollar agent interview questions for sellers?

Let’s create one right now.

- Do you use professional photography to market homes?

- Do you provide a 360 virtual tour?

- Can you target ads to home buyers online that are looking to purchase now?

- Explain how you find these buyers online?

- Do you partner with Google’s #1 ad provider to provide top search results?

- Should we use a smart lock box for showings?

- Should the seller be present for showings?

- When is the best time of year to sell?

- Do you require proof of funds/and or a pre-approval letter with offers?

- What is artificial intelligence and why is it important?

- Does your company provide artificial intelligence, and do you have big data to power results?

- Do you operate as a single agent or a team, and why is that critically important?

- How many homes has your team sold in Lee County?

- Should I gamble on a newer agent with less experience?

- How many sellers did you successfully represent and close in last 12 months?

- How many listings expired, withdrew, or terminated with you in last 12 months?

- What is your average list price/sales price ratio?

- What is the average agent list price/sale price ratio?

- Can we video conference meetings if we’re not in town?

- What are your average days on market?

- What are the average days on market for homes like mine?

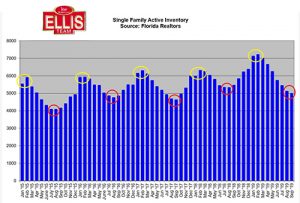

- Do you have a Blog where I can see current research on the market?

- Do you have a database of buyers searching in my neighborhood?

- Show me your database of buyers, minus the private data of course

- Do you reach International buyers?

- Would an agent with zero to few listings be better to sell my home?

- What are the dangers of working with an agent with limited listing experience?

- What are the 3 P’s in real estate?

- Is listing my home on the big national portals a big deal or can anybody do that?

- What do you charge?

- How long is the listing for?

- Why should I hire you?

- What if I’m not happy with you?

- Will I net more using you versus selling it myself?

- Show us your online reviews, client testimonials, or newspaper poll awards.

- Is this a price range you feel comfortable in?

As you can tell, we love tough questions. The truth is, none of these questions are tough. They’re on the mind of home sellers. We get asked these questions a lot. Some sellers ask one question, or several, but none ask all of them because they’re not used to interviewing agents. It’s something you only do when you’re considering a move.

Keep this list handy for when you’re ready. We’ll post it on our Blog too in case you lose it. We hope this list will spark a few more questions for home sellers. A better interview will lead to a better agent selection, which should lead to a faster home sale and at Top Dollar. That’s all a seller really wants is top dollar and an easy, painless home sale. Selecting the best agent goes a long way to this end. This checklist will work in any market, so hang onto it.

If you have questions, please call Brett or Sande Ellis 239-489-4042 Ext 4, or visit www.SWFLhomevalues.com for a quick and free home value computer estimate. Better yet, call us and we’ll meet with you and discuss your options.

It’s fun to go back and look at how we did things in the past. Here is an article from 2013 “How to Interview an Agent to Sell Your Home”

Good luck and Happy Selling!