Sellers around SW Florida should be happy. Actually buyers should be too, which is a rare thing indeed.

Official numbers weren’t released as scheduled due to the holiday week, so we ran our own numbers which should be pretty close. Once official numbers are out we’ll revise our charts to reflect official data, but in the meantime we’ll analyze why people should be happy in SW Florida.

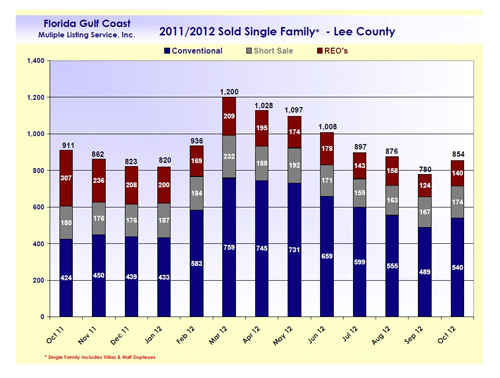

As you can see, median single family home prices in SW Florida continued their upward trend in 2012, rising to $135,000 in November. Each month traditional sales have risen which means less percentages of distressed sales. Sellers will like this because not only are prices rising, but more people can afford to sell with the rising prices without having to sell as a short sale or foreclosure.

Buyers surely love this market as well. More traditional sales means less buyers have to wait months and months for an answer on a short sale. That’s always a scary proposition because market inventory is light anyway. It’s never fun to have a bid in on a house waiting patiently for an answer from the seller’s bank while more homes come and go on the market, never knowing exactly what the bank will do with your offer.

Buyers are also happy with prices. Sure, they’re not at their lows in 2009-2010, but many buyers didn’t buy back then anyway because they were afraid it wasn’t the bottom. Investors propped up the market back then and bought most of the homes traditional buyers were afraid to buy. Regular buyers rarely purchase at the bottom because they’re too afraid prices might dip lower.

Rising prices prompt buyers to say “Darn, we missed the bottom, but we better jump in now before things go higher. We can still get a good deal.” Buyers actually like the confidence of knowing other buyers feel strongly about the market too. It’s called the herd mentality, and it’s true on Main Street and Wall Street.

So buyers have their confidence. They also have very low interest rates. Home affordability is high which means buyers have purchasing power.

Heading into the New Year we have a wish list for the SW Florida real estate market. They won’t all come true, but we can wish can’t we?

1. More Inventory

2. Repeal of Dodd-Frank Act

3. Extension of Mortgage Interest Deduction

4. Improving Economy

5. More Jobs for SW Florida

6. Budget Fix by Congress-President

We don’t control many of these factors here locally. If by chance we were able to do several things on this list, the local SW Florida real estate market is poised to take off like a jet. Our market has seen some pain over the years and has been recovering nicely. We are starting to see the fruits of that recovery this past year or more.

How fast this jet takes off is due in large measure to how fast we address the 6 issues. So sit back and enjoy the fruits of our market, and with any external luck, those fruits could turn into treats.

Here’s to a great New Year to your family from ours!!!! Cheer Cheer!