The Ellis Team has been hustling all of 2019, and December is no exception. The phone is ringing, leads are pouring in, showings are happening, and sales contracts are being written. December real estate activity seems busier than usual which makes for exciting times for the local SW Florida real estate market.

We’ve seen this before. Sometimes as agents we get so busy through our marketing and lead generation efforts that we falsely believe the market is strong simply because we’re busy. I’ve spoken with other agents and some are busy, and some aren’t. That probably largely depends on their lead generation efforts. All I can say is there is business out there if you work hard, advertise, and lead generate.

December Real Estate Activity

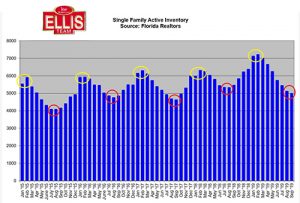

I decided to pull up a 7-day Market Watch report from the MLS. The last time we did this was back in September. Comparing this December report to September’s report we notice a few things. Back in September pending sales outpaced new listings 359 to 299. In December, new listings outpaced pending sales 377 to 326. The number I’m focusing on is the pending sales. In September they were 359 and today they are 326. That’s not bad when you consider it’s December. Many agents take the month off because it’s the holidays and they figure there isn’t much business. The numbers say there’s about as much December real estate activity as there was back in September.

September Real Estate Activity

The other number I’m looking at is the sold. In September it was 233 for that 7-day period. In December it is 270. That’s a big increase. Keep in mind that the closed sales went pending last month or more, so all this tells us is that November may have been busier than August.

We’ve got a pretty good market here in SW Florida. You still have to price properties correctly, and they don’t just sell themselves. There are buyers though, and that’s a good sign. Buyers are looking right now too. If you’re a seller, I wouldn’t turn down too many showings. Any buyer out looking right now could be serious.

Looking forward to 2020

The Ellis Team just had our team retreat last week. We don’t call it that because retreat sounds like a backwards word. We call it a Team Advance because we’re moving forward, not retreating. Anyway, together we came up with our plan for 2020. Everyone on the team was extremely optimistic about this next year and the opportunities it presents.

We laid out all the new marketing we intend to implement and several new strategies to advance our clients sales. Every single person on the team did a presentation for the group and it was one of the most powerful days of learning and growth I can remember. I was super proud of our entire team and how well they prepared and delivered each of their presentations. A lot of growth happened that day, and as a team we grew in untold ways.

I believe our current and future customers benefited too, because the ideas shared were incredible. Our team is pumped up and ready to serve and we believe 2020 will be great for not only our team, but our customers as well.

SW Florida Real Estate Market Outlook

We’re in a favorable interest rate environment combined with one of the best job markets we’ve ever seen. SW Florida made lists for top job opportunities in the country. Job income is outpacing mortgage payment increases, so that is a terrific sign for future growth in the market. That’s one of the biggest things we look at.

SW Florida is SW Florida, and our weather is always fantastic. With the economy moving in the right direction and favorable rates, combined with all Florida has to offer, we believe 2020 should be a prosperous year.

If you have a home to sell, Call Sande or Brett Ellis 239-489-4042 Ext 4 If you’re not ready to talk to us yet, we have a website that will give you a pretty good estimate of your home’s value. Check out www.SWFLhomevalues.com We don’t sell your data like the big websites do, so it stays with us and is much safer.

See last week’s article “New Real Estate Listings Entering the Market Rises in October”

Good luck and Happy House Hunting!