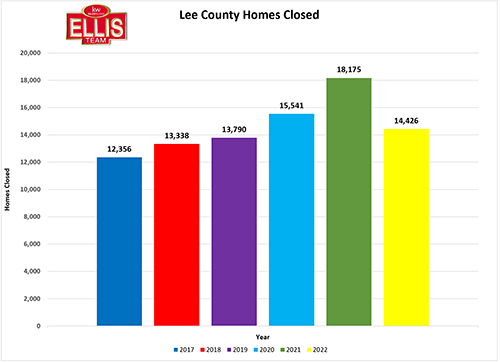

Rising interest rates led to Lee County home sales decline of 20.63%. Nationwide home sales fell 17.8% in 2022 which was the sharpest annual decline since 2008.

Hurricane Ian Impact?

You might be wondering if the hurricane had an impact on our local sales. I went back and analyzed sales prior to the hurricane and we were down 12.24% through August. It is safe to say Hurricane Ian did negatively impact home sales as many homes were not sellable after the storm.

Experts are predicting home sales to fall further in 2023. One prominent trainer is telling agents to prepare for a further 35% fall in home sales nationwide. I just checked sources and here is what they are predicting:

National Association of Realtors predicts 7.0% decline in number of homes sold. Fannie Mae predicts 21.1% decline. Mortgage Bankers Association predicts 13.7%. National Association of Home Builders predicts 15.7% decline. Realtor.com predicts 14.1% decline in 2023. The bottom line is everyone is expecting less home sales in 2023.

The reasons for declining sales are many. Inventory is still low. Interest rates are still high but have come down some. Personally, I think SW Florida might do a little better than the national averages.

As damaged properties receive insurance proceeds and get fixed up some will go on the market. We have seen inventory levels shoot up throughout 2022 and the trend is continuing into 2023. Demand may not be what it once was, but there is still demand.

Buyers Are Here

Already the first two weeks of January have seen stronger buyer demand. We may not have 50 offers per property, but we are still seeing full price offers on homes that are priced appropriately. Sellers are more reasonable as they understand we are not in the market of 2021 anymore. Home prices are well above what many paid for their homes. While sellers cannot get as much as they want, many are satisfied with what they can get.

Of course, the market does have some sellers that still believe it is March is 2022 and they want those prices, plus a premium. I’ve worked in the SW Florida real estate market for 35 years and no matter the market there will always be some unrealistic sellers. I can say the same for buyers too. The deals happen when the unrealistic face reality and become realistic. The only difference is how long it takes to get there and how much does it cost them to be unrealistic.

I’ll give two examples. Many sellers get caught chasing the market down because they were unrealistic. At some point circumstances change and now they must sell. They sure do wish they had sold earlier when prices were higher.

Similarly, we’ve spoken with many buyers that came down and didn’t like our prices because they had gone up. They wanted last year’s prices and were willing to wait out the sellers until the market gave them the price they desired. Later, they regretted missing a 100% rise in prices. Those buyers were so ate up with a 10% rise that they missed home prices doubling.

View all listings in MLS here.

2023 and Beyond

We believe interest rates have stabilized and may bounce around where they are. With any luck they might even touch the 5’s soon. We know many companies have planned layoffs in the coming months. The Fed may raise rates again in February and March by 25 basis points each. At some point soon they may signal they are about done raising. This does not mean they will lower them in 2023. Many believe this process wouldn’t begin until 2024. If this scenario occurs, we could see 30 year mortgage remains remain steady or dip slightly, perhaps into the 5’s. This would setup a balanced real estate market in 2023 with prices neither rising nor falling much. We’ve already seen price declines in 2022 but nobody knows it. Inventory levels and pending sales will be what we keep watching in 2023. Lower interest rates could lead to a rise in Lee County home sales.