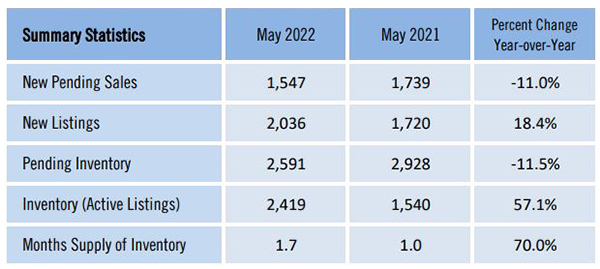

Local pending sales drop as inventory rises which caused the month’s supply of inventory to rise 70% in May over last year. New pending sales dropped 11% in May 2022 versus May 2021, while overall pending inventory fell 11.5%

The drop in pending sales comes at the exact same time as inventory rising to 57.1% year over year in May. This explains why we are seeing price reductions. New supply to the market is outpacing demand. We still have excellent demand, but the market is not absorbing all the new listings coming to the market.

The month’s supply of inventory rose to 70% to 1.7 months supply. 1.7 months is a historically low figure, and yet we know the supply is outpacing demand. This number will not stay at 1.7 months’ supply.

Price Reductions

Today I looked and there were 2,629 single family homes on the market in Lee County. 947 of the 2,629 homes on the market recently had a price reduction. This means 36% of all homes on the market today have had a price reduction since they listed the home.

The most fun time to be a seller statistically was back in February. Don’t get us wrong, it’s still a great time to be a seller, and homes are selling well, if it is priced correctly.

The question is, is it more fun to be a seller today than it will be a month or two from now? We know it was more fun a few months ago, and by the trend we are seeing in the numbers, it very well could be more fun today than in the future.

We have been telling sellers for months, the sooner you decide to sell the better off you may be. This is true today as well. We are studying preliminary sales numbers for June, and it looks to us that median sales prices will be down against May numbers.

Sales Prices Lower

Official May median price was $469,950. I just pulled up all single-family home sales in Lee County as of June 28th, the day this article was written, and median sales price came in at $449,950. That is a $20,000 drop if the number holds up. Keep in mind, there are some outstanding sales yet to be recorded for the month.

Average sales prices look to be lower in June as well. Official May average was $658,886 and the preliminary average is $598,413. That is a $60,000 drop. Again, there are some outstanding sales that could change these numbers.

Top Dollar

While we have an excellent market, the data suggest the market is cooling. Your Top Dollar may be today, and every day you wait may cost you money. If you are thinking of selling, sooner may be better than waiting. If your home is on the market, adjusting your price to get it sold today may be better than waiting. If the market continues cooling, it may not be as fun a few months from now.

A word of caution though. Median and average home sale prices traditionally decline about this time of year, so don’t make too much out of it. More luxury homes sell in first quarter every year. What is different this year is inventory is rising.

The Fed is also tightening, and the lending market has risen. We may be in a recession, or close to one. With all these events happening simultaneously it may be safe to assume prices have stalled until we get back to a lower interest rate environment.

If you have a property to sell, you should talk to Sande or Brett Ellis 239-310-6500 We study the market and can give you up to the minute advice. When the market changes you need an experienced agent who’s been through a shifting market and knows how to handle it. Check your home’s property value on our site at www.SWFLhomevalues.com

Good luck and have a Happy July 4th Weekend!

Ellis Team Weekend Open House

Saturday 12-3 PM

4 Bed 2 Bath Pool Home