Most people don’t realize that their Home Equity Line of Credit (HELOC) could be facing some stiff payment increases in the coming years. If you bought a home in the 2000’s chances are your lender discussed adding on an interest only line of credit to your first mortgage in case you needed money in the future.

Lines of Credit Payments About to Skyrocket

Some people used the line of credit from the get-go to avoid paying PMI insurance. It was an attractive option as it was probably interest only and the payment was affordable. Many are as low as 3.25% Rates are still that low today but the rates can go up at anytime, but that’s not what has the banking industry worried.

The part that wasn’t fully explained to consumers is that the interest only portion lasts for the first 10 years. After that, the borrower must begin making principal and interest payments, which will add money to your monthly payment even if rates don’t rise. But here’s the kicker. The new payment is amortized over 15 years, not 30 years, so essentially you have to pay back the entire HELOC over 15 years in addition to your 1st mortgage.

Let’s say you have a 1st mortgage and a $200,000 interest only HELOC. At 3.25% the HELOC monthly payment is $541.67. With the new amortization that payment increases to $1,405.34 If it was based upon a 30yr amortization the payment would be $870.41, still a substantial increase. Unfortunately it’s not, so get ready to pay a lot more.

Now, let’s assume the interest jumps to 4.5%. These rates can adjust at anytime as the market changes, and most economists predict they will go up. At 4.5% amortized over 15 years that same payment jumps to $1,529.99

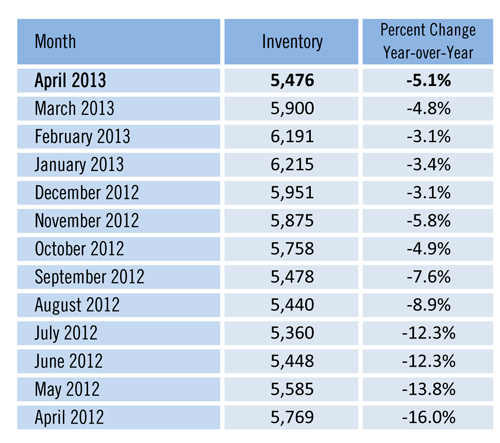

You can see from the chart when the HELOC originations started jumping. Many SW Florida homeowners are up against this reset now and many more will be hearing about this subject in the next few years. It is a shock when you’re not expecting, but homeowners who act now have a chance to do something about it.

You can start making the extra payments voluntarily now which will reduce the principal when your loan does reset. This also gets you used to the higher payments and allows you to budget properly.

For some this will not be feasible. If you have equity now and good credit you might look at refinancing both loans into one mortgage. It’s much harder to get a loan today than it was 10 years ago, but if you can that may be a great option. If you cannot refinance, you may want to look at selling now, especially if you have equity. It would be a shame to come up against the deadline and be forced into delinquency because you can’t afford the higher payments if you have equity.

If you are upside down on your mortgage, you can either start talking with your lender now or look at doing a short sale. Nobody wants to go into foreclosure. Many have resisted a short sale up until now, but a short sale is much better on your credit than a looming foreclosure would be.

We’re not here to tell you what you should do. That’s a personal decision and maybe one to be discussed with your attorney or accountant. We are here to educate you on what’s coming and tell you about your options.

If you think you may want or need to sell, please give us a call. We’re experts at looking at the situation and listening. We’ll get you top dollar for your home and help you move on. So many people have been locked into their homes waiting for the market to rise, and it has. Perhaps the market has risen enough for you to sell now. Perhaps it makes sense to down size, upgrade, and move to another location, etc. We can help. Give us a call at 239-489-4042 If you’d like to search the MLS first, go to www.Topagent.com and you can see what homes like yours are selling for. Of course there’s no substitute for meeting with us and us evaluating your home. We look forward to working with you to sell your home, or to buy one.

To search the MLS for properties go to www.TopAgent.com or give us a call at 239-489-4042 You can even search for waterfront property in Fort Myers, Cape C oral, or all of SW Florida Good luck and Happy House Hunting!!!