New sales numbers are out for the SW Florida real estate market and we’ve been pouring over the numbers and we’ve come to the conclusion that sales are directly related to the amount of inventory on hand. We can’t sell what we don’t have, and if we had more we could sell more.

Perhaps a better headline would be sales are directly related to the amount of fairly priced homes on the market. In any market, up, down, or sideways, there are always fairly priced homes and overpriced homes. The fairly priced homes sell in any market, and the overpriced homes fail to sell in any market.

SW Florida Real Estate Market Update

The median sales price fell in May to $195,000 from $200,000 in April, but it is up 10.6% over May 2013 levels. Inventory rose slightly to 5,540 listings which was up 6.3% over last year. Each month new listings come to the market and some are selling, and some are not. Pending inventory fell 10.9% from last year, so we’ll keep an eye on inventory rising and pending inventory declining in the coming months.

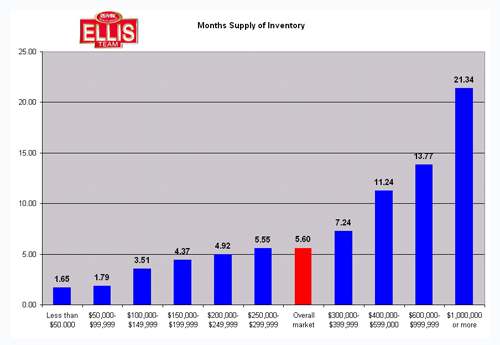

I’d like you to look at the two charts provided. They may look confusing but it’s really not. One is the median days on the market by price range and the other is the months supply of inventory chart. The difference is the months supply of inventory takes into account all single family listings to give you an idea of how much is on the market.

The median days on the market by sales price chart only looks at homes that actually sold, not all listings. These are the listings that have won the home selling game. If priced correctly, a home will sell, and these homes did. In other words, if a home is going to sell, these are the median average times it will take. If you have a home on the market you can lookup what price range you’re in and see the median time. If your home is over the median time, perhaps your home is overpriced and isn’t going to sell.

That’s a tough pill to swallow when you read headlines that say the market is improving, and there are multiple offers on many properties. This is all true. However, there aren’t multiple offers on all properties. And some properties receive no offers.

It doesn’t matter how good the market is, nor how much marketing your Realtor throws at your property. If it’s overpriced, it’s not going to sell.

Cash sales have fallen to 52% of all sales, and this time of year they typically fall further. Financed sales must appraise, and we have seen some appraisal issues on properties lately.

If your home isn’t selling, it’s time to have a conversation with your Realtor about proper pricing. The seller may set the price, but the market determines the value. If your home is over the market, then it’s not really on the market. If you wish to sell you’ve got to price your home at or close to where the market is. Some sellers don’t really care if they sell, so they continually keep their home over the market and if a buyer comes along and pays more than market, they’ll sell. We’ve all seen these listings. They just linger on the market and make all the fairly priced homes look good. They get fewer showings and few offers, because serious buyers offer on fairly priced homes first. They don’t waste time offering low on overpriced listings. Buyers go for value, and overpriced listings don’t offer value.

This is probably the biggest mistake we see sellers make. They assume buyers can always make an offer, but they don’t. Many times the overpriced home is invisible to the buyer because it’s over where they’re looking.

We don’t suggest under pricing your home. Just price it fairly and you’ll be glad you did. Good luck and Happy Selling!

To view our Listings in Hi Definition, visit www.HomesinHD.TV or click on our playlist below

Fort Myers Real Estate Agent

7910 Summerlin Lakes Dr

Fort Myers, FL 33907