Good news for home buyers and home sellers in Lee County. Conventional loan limits increase to $548,250 in Lee County. The previous loan limit was $510,400. Because sales prices have increased this past year the loan limit was increased.

If a buyer wished to finance over the $510,400 it made the loan a jumbo loan. The interest rate may have been higher and the underwriting guidelines in some cases could be stiffer because jumbo loans are not insured by FNMA or Freddie Mac.

Conventional Loan Limits Increase

The increase to $548,250 means a buyer can pay more for a home and still meet conventional loan guidelines. Interest rates are around 2.5% for people with good credit. This eases down payment pressure for many buyers who need a conventional loan.

Let’s say a buyer wanted to buy a home for $600,000. Under the old guidelines the buyer would have had to put $89,600 down to stay in a conventional loan. Today the buyer could put down $51,750 and still meet conventional guidelines. That would be 8.6% down payment which is acceptable.

With conventional loans the buyer can put down as little as 3%, but 5% is more realistic for most people. The PMI rate (Private Mortgage Insurance) declines the more a borrower places in down payment, and it disappears entirely if buyers put 20% down.

Buyers Can Afford More Home

The bottom line is buyers can absolutely afford more home today than they could last year. Down payment requirements are less and interest rates are less. This is good news because prices have been going up, so this alleviates that pressure.

This is one more reason we believe there is still fuel to power prices higher. Of course, low rates will not help if the economy crumbles or demand falls. We do not see any signs of demand falling. In fact, Florida is more attractive than ever to northern buyers in high tax states. Companies are leaving northern states and relocating to Florida, so it is not just remote workers making the switch.

Conventional loan limits increase benefits sellers as much as buyers because more buyers now qualify for the same property. We already have multiple offer situations on many properties, and the conventional loan limits increase may add to the demand for properties priced $535,000 and higher.

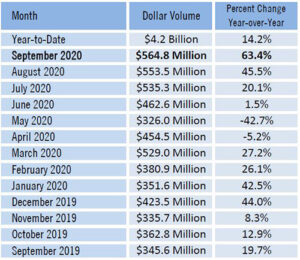

In the coming weeks we will report final 2020 real estate market numbers. To date we have official numbers through November, and we expect 2020 to end with a bang. Traffic on our roads is busy, and our team has been busy working with buyers from all over the country attempting to purchase a home.

By all accounts, 2021 should be another great year. The only thing that may hold it back is lack of inventory. Sales could decline simply because we do not have enough inventory.

Considering Selling?

If you are considering selling, please call Brett or Sande Ellis 239-489-4042 Ext 4. Now may be the best time. Our marketing is reaching local and out of town buyers, and they are making offers. Our team is working harder than ever for our clients. We are getting sellers who list with the Ellis Team top dollar. It is always more fun to sell when we attract multiple buyers for your home. Sellers can sit back and select the best offer, but that is only possible when you saturate the market. Advertising locally and nationally is the key.

Or you can check your home’s value instantly at www.SWFLhomevalues.com Prices are changing by the week so it pays to keep up. Is there a price you would sell your home at? If so, perhaps we should talk. Always ask for Sande or Brett Ellis. There is no substitute for experience.

January 2021 SW Florida Real Estate Market Update