Official sales numbers are out for December and by all accounts the market looks in pretty good shape. Now that we have 12 months of data we can calculate year end sales numbers. I will say upfront my calculations differ from the Board of Realtors numbers. We’re both using the same numbers so I have a call into them to see how they’re calculating numbers.

2013 SW Florida Real Estate Market Headed in Right Direction

For the record, I don’t think it makes a whole lot of difference. They are reporting, media sales prices rose 29.9% from $97,000 in 2011 to $126,000 in 2012. We are reporting sales prices rose 24.31% from $105,469 in 2011 to $131,108 in 2012. I used a methodology used by the Florida Association of Realtors. The Board must be using another methodology. I’m not saying either is right or wrong. In fact I have a call into the Board to look at their method, and if that method makes sense we may restate our numbers. Keep in mind both methods are based upon same set of monthly numbers so that’s not in doubt. The difference is in the calculations, and both tell a similar story.

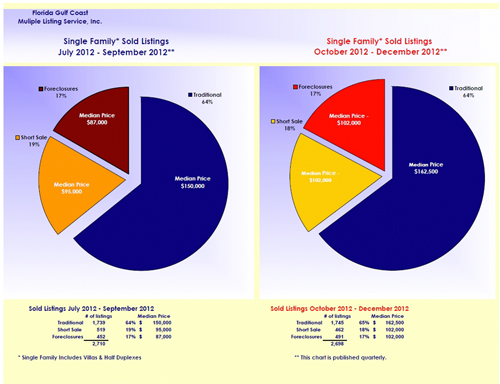

Another newly released chart I like to look at is the breakdown of traditional sales versus distresses sales and prices. While traditional sales remained at 64% for the 4th qtr of 2012, prices for those traditional sales rose $12,500 to $162,500. Foreclosure sales rose in price $15,000, and short sale prices rose $7,000 in the 4th qtr.

Back in 2009 approximately 70% of all single family sales we distresses, and today that number is down to 36%. This is one reason we see rising prices, and as prices rise more and more SW Floridian’s can afford to sell.

In quarters past we’d see price movement in one type of property but now we’re seeing it across the board. Inventory rose just about 400 homes in the 4th qtr however we’re still at a 4.0 month supply of homes on the market which is fairly low. Buyers coming for season will have a harder time finding properties and there will be more multiple offer situations.

Look for 2013 to be the beginning of builders getting back into the market. Prices probably aren’t high enough for a full onslaught of building like we saw in the early 2000’s but we should see an uptick just the same.

As we build more and as the economy improves the SW Florida real estate market is poised to takeoff. All the numbers line up for a market headed for much higher ground. The only variable holding us back is the overall economy. Once that improves, watch out. This market will be all green light Go.

Buyers from up North have been buying the past year. They knew prices were headed higher and they’ve reacted. Buyers this year still have much opportunity ahead of them but prices are rising currently so the sooner you find your dream home the sooner you’ll lock in today’s prices. If you’re in a solid financial position to purchase I’d say buy now and then pray the economy improves versus the other way around. Waiting could really cost you money.

If you’re a seller looking to trade out of your property keep in mind that as your property goes up in value so does the one you’re looking at buying. Talk to a real estate professional about your particular needs. You can always call the Ellis Team at 239-489-4042 if you need help.

Good luck and Happy House Hunting!