Expect large interest rate hike at next Federal reserve meeting Sept 21st. Inflation numbers were released this week and CPI rose .6% over last month and 8.3% over last year. This number came in hotter than expected and left the Fed little choice in raising rates.

Most experts now say a .75% hike is certain. Some were hoping for a .5% hike, and still other fear 1% hike as a possibility. Our bet is on the .75%. The bad news is that persistent inflation may lengthen the time before the Fed can begin lowering rates. Many hoped for lower rates next year.

If our government keeps spending money, the Fed will have to keep raising rates. On the one hand rising rates should stifle economic activity while on the other, more spending adds to the money supply we are trying to slow down. We have competing forces instead of both working together to fight inflation.

National Call

We sit on a national call each week of top agents. This week they reported that housing demand had dropped due to higher interest rates. Nationally, inventory stalled. Over 40% of listings had at least 1 price reduction. When that number gets to 45% it is considered bearish. The average is 30% for those that are wondering.

Pending home sales nationally are down 22% year over year. Showing requests are down 41.2% nationally, and closings are down 17%.

Target Rates

The Fed had set a target rate of 2.25% to 2.5% for 2022, but many Fed governors are now saying they may have to raise that rate to 3.5% to even 4%. The 10 Year note typically will follow the target rate because it is longer duration and helps predict what the economy will do after 1-2 years out. So far, we have seen the 10-year note creeping up. As we write this article on Sept 13th it sits at 3.432% Remember, 30-year mortgage rates are pegged off of the 10-year note. As we get closer to Sept 21st and future guidance by the Fed, we expect this target could increase, which could increase the yield on the 10-year note. If that happens, mortgage rates will increase, putting further pressure on stock market and real estate market. We expect large interest rate hike later this week.

We expect the stock market to do better later in the year, but we may have some rocky weeks until then. The real estate market may feel pressure until we get ahead of inflation and start to see the downslide.

Local Statistics

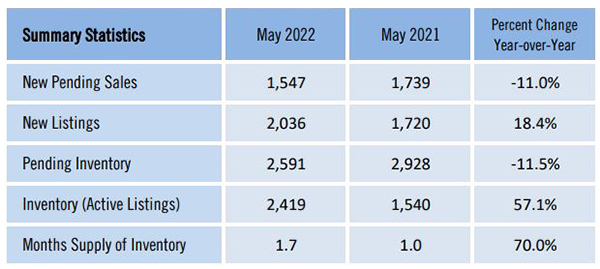

Locally listing inventory has also stalled. Closings are down but pending inventory has also stalled. Demand has been persistent, and if we don’t see a major influx of sellers, we should see stable prices going forward. If more sellers decide to pile on to our inventory numbers, it could lead to modestly lower prices as we do not see demand picking up in a rising rate environment.

New Seller Program

The Ellis Team has a new program designed to get sellers Top Dollar and sell quickly. Call Brett or Sande Ellis for details 239-310-6500. The program is so good it has several patents at the US Trademark Office, and we are pleased to be able to bring this program to our area.

Or, if you’re just curious about your home’s property value, or would like to track it over time, check out www.SWFLhomevalues.com It will be interesting to see how continued rising rates will affect the market.

If you have real estate questions, we’ve got answers. Give us a call. Always Call the Ellis Team at Keller Williams Realty, your local market experts.