For the past two years we’ve been talking about lower interest rates fuel home sales and their impact on pricing. Today we have some data to illustrate how lower interest rates fuel increased pending sales. And we all know pending sales lead to closings.

Last year the Fed made a mistake and began raising interest rates, which led to higher 30-year mortgage rates as well. These two are not always tied together, but in this case that was the effect. As you can see from the interest rate chart, rates began rising in 2018, especially in the latter half when the Fed did what they did.

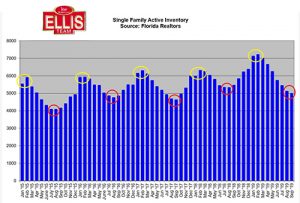

As rates shot up to 5% at the end of 2018, home sales lagged. Beginning in November 2018 new pending sales fell off about 20% and continued its slide until April of 2019. March 28th is when we saw our first real dip in rates, which led the turnaround in new pending sales immediately. Beginning in April new pending sales turned around, and they’ve continued since. In fact, this September we saw the largest increase of 19.6% This is a function of lower rates now combined with rates that were rising at that time last year.

Lower Interest Rates Fuel Increased Sales

Last September new pending sales were falling and this year they’re rising. These two charts illustrate perfectly well the effect lower interest rates can have on home buyer’s motivation. Lower rates open more opportunities for buyers as well, as they can afford more home for the same payment.

The interesting thing will be what happens moving forward. Interest rates are moving up while the Fed is lowering rates now. The Fed is in pause mode now to see how monetary policy shakes out both here in the US and globally. Like I said earlier, these two rates are not always tied together.

When word gets out that rates are going back up, it will have one of two effects. It may spur some buyers who were on the fence to act, which could increase new pending sales. It could also have a chilling effect, because as rates go up, sales can go down. Fewer buyers qualify at various price points, so it essentially takes some buyers out of the market.

We can’t say moving forward where mortgage rates will be next year. There are plenty of variables, not the least of which are trade deals. Secondly, the sad reality is the world is broke. Nobody really has any money, it’s all borrowed. We see countries in Europe with negative interest rates because their economy is in trouble. The United States is still the strongest economy on the planet, so we don’t have the need to go negative like these other broke countries. However, we owe a lot too, so we must be careful with spending programs to avoid the fate of some of these countries.

The good news is our economy is booming and could be better once these trade deals are worked out. Ironically, certainty in the market may spill over and help these other countries too, if they pay attention and rein in spending.

So how does all this affect real estate here in Southwest Florida? Lee County prices have been very stable the last few years. We haven’t seen big price run-ups. We should be in good shape no matter what happens globally. While the Fed made a mistake last year, they’ve been doing a reasonably good job reading the financial tea leaves and keeping the US steady.

30-year rates today are at 3.78% on average. That’s really good, and if we keep rates below 4% we should continue to see excellent sales numbers moving forward. It’s when rates hit 5% last year that we saw slowdown.

We’ve helped buyers save big on closings costs through a lender we work with. If you’re thinking of buying, you should call the Ellis Team at Keller Williams Realty. 239-489-4042 and speak with one of our buyer agents. If you’re thinking of selling ask for Sande or Brett at Ext 4, or visit www.SWFLhomevalues.com

Good luck and Happy Home Buying!

We have 7 open houses this weekend. Call our office for complete schedule 239-489-4042