SW Florida sure dodged a bullet with Tropical Storm Isaac. A few people actually seemed kind of let down the storm was a dud for our area. Not us, we’re glad the storm sideswiped us so we can get back to business.

When things are going well you don’t need a timeout. Have you ever watched a sportscast and noticed it’s usually the team that’s struggling that calls a timeout? A timeout gives them a chance to regroup, catch their breath, re-energize, formulate a new strategy, or think of something different to change their plot.

SW Florida needs no timeout right now. In fact, I think we can handle some more. We’re firing on all cylinders and actually could use more listings. Sales would be higher if we had more inventory to sell. The proof is in the pudding, so let’s take a look at the numbers.

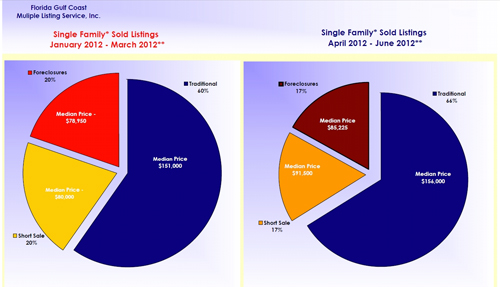

Traditional sales rose 6% in the 2nd qtr of 2012. Remember not too long ago distressed sales accounted for 71.86% of all single family home sales in Lee County in 2009. In Lehigh Acres it was worse at 88.5%. Fast forward to today and we have a much different picture. In fact, traditional sales were not only up in percentage, they were also up in actual units rising from 1,896 the 1st qtr to 2,188 this past qtr. Short sales declined from 20% down to 17% as the actual units dropped from 647 the 1st qtr to 566 this past qtr. Bringing up the rear was foreclosures which were 20% 1st qtr and 17% 2nd qtr. Actual units were 628 foreclosure sales 1st qtr and 560 the 2nd qtr.

This wasn’t a case of all three types of properties falling and only the percentages changed. There was an increase in traditional sales and a decrease in distressed sales, all indicative of a recovering market.

Some wonder if the market’s as good as we say it is, why haven’t prices gone back up to 2006 levels and the answer is those were artificial numbers and were not sustainable There were voices speaking back in 2005 that the market was in trouble but few would listen. The economy didn’t support those levels then and they sure won’t support them now. The economy has worsened since then and until we see a rise in jobs, income, and savings we won’t see whopping price increases. However, most agree our market is undervalued while it is steadily progressing in price. Our market is ready to take off once economic conditions improve. In the meantime, we’ll take the slow and steady gains of the past year or more.

Our nation and economy is at a crossroads, and the outcome should arrive fairly soon with the election in November. The politicians have not been straight with us because they’re afraid we’ll fire them. The truth is we spend more each year on entitlements than we bring in, so it wouldn’t matter if we cut the entire budget, there isn’t enough to pay our bills. We either need to grow revenue to the government or cut entitlements, or perhaps both.

The big argument will be how to cut entitlements, and how to grow revenue. Obama says raise taxes on the rich. Others say cut taxes on the rich and revenue will grow like they did under Reagan. Taxes are just half of the equation and it’s a losing proposition if you don’t also look at entitlements. It’s a conversation America needs to have, not one which we want to have.

Entitlements eat up the entire revenue, and yet Bush increased them with prescription drugs and Obama did with health care. If we can’t afford what we have, why are we adding to the debt? Greece had austerity measures forced upon them by their creditors and they didn’t like that. We won’t either. Right now we have choices. In a few years we won’t. America was founded upon us choosing our destiny. I’d hate to see the world tell us in a few years how we should govern ourselves, but if we can’t do it, assuredly someone will soon.

As we said earlier, our local real estate market will ultimately be dictated by jobs and the economy. Jobs and the economy might very well be dictated this coming election, so our crystal ball should be arriving sometime in November. Stay tuned, and Happy House Hunting!