This month is particularly interesting to study the latest real estate statistics as we really wanted to see what effects if any the foreclosure moratoriums would have on the market, and already we’re seeing some interesting data. Watching these stats move feels similar to watching a heart monitor and patient’s vital signs. I guess these statistics are the vital signs of our local market, so let’s dig in and see what the signs are telling us.

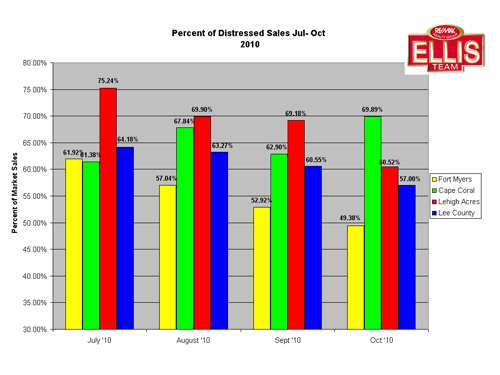

Some of these statistics interact with each other in a cause and effect way. For instance, some foreclosure listings were pulled in October and distressed sales were down in October. Distressed sales were up in Cape Coral, partly because foreclosure closings rose by 34 sales, and partly because short sale closings rose by 14. Everywhere else short sales and foreclosure sales were down.

Inventory levels rose in Fort Myers 3.12%, but fell in Cape Coral and Lehigh. Countywide inventory levels are up less than 1% from the previous month.

Closings were down about 8.45% in October from September levels. Fort Myers sales were down 16.49%, Lehigh down 20.21%, but Cape Coral was up 6.88% over the previous month. Cape Coral can be explained by the increase in foreclosure sales and short sales, and this may account for why the rest of the county’s sales were down as well, because the rest of the county’s distressed sales dropped. So there seems to be that cause and effect in play we mentioned earlier.

Going forward pending sales are up county wide, and Lehigh Acres leads the way with pending sales up 5.44% over pending sales last month. Cape Coral is up 1.92%, and Fort Myers is flat. We track pending sales as pendings lead to closings, however not all pending sales close, so it’s just a vital sign we track.

We have noticed an up tick in buyer call activity and Internet traffic, so there is definitely buying interest in our market. Banks have begun to release the foreclosure moratorium, so inventory levels may stabilize which will help transactions move forward.

Total distressed sales have fallen 4 straight months, but this could change as inventory levels have been driving sales numbers. Demand is in the market and this is a case whereby supply is dictating certain aspects of the market. Any disruptions to supply will temporarily affect sales numbers, and this should not be misinterpreted as decreased demand. This past month’s results were supply driven.

Keep in mind these are internal tracking we compile and not official sales numbers which won’t be released until next week.

Where will the market head from here? We believe supply will even out as banks get on top of some of the affidavit issues which plagued some of their foreclosures, and it may force some banks to work a little harder at completing short sales, which would be a good thing.

We are heading into season, and if this year is anything like last year, there was serious demand from our northern friends last season which could bode well again for this season. This season “Feels” a lot like last season, as traffic has picked up on our roadways, as has real estate traffic, phone calls, and Internet traffic. This season could be a chance to work down even more inventory, and it would be nice if that excess distressed inventory is available while the visitors are here rather than gracing our presence after they leave. We’d just as soon sell and dispose of it now than have it come back and haunt us later when the demand might be less.

When it comes to supply, I say “Bring it on”. We don’t feel holding it back shadow inventory serves any greater good and only prolongs agony later. Others may disagree and argue that saturating the market further drives down prices, but so does an expanded process.

Ask anyone in the job market if they’d rather have a very deep recession lasting 3 years or a deep recession lasting 6 years. I think most would rather take their medicine and get it over with so the healing can begin sooner rather than later. Here in SW Florida we’ve been dealing with a declining market for 5 years now, and many would like to just get it over and begin that healing process. We don’t want banks or government deciding to prolong the agony SW Florida has suffered for 5 years, as jobs and our local economy takes its cue from real estate. The sooner we heal this market, the sooner construction jobs and the economy bounces back, and who wouldn’t be in favor of that in SW Florida bout now, or anywhere for that matter?

Visitors are here, pending sales are rising, and inventory is stabilizing, so let’s hope for a great season and a good 2011.