SW Florida Listing Inventory Down

This week we’ll focus on the amount of single family home inventory in Lee County and

compare that with pending sales activity from a historical perspective so that we might be

able to draw some conclusions as to what’s happening today in the SW Florida real estate

market, and where the market may be headed.

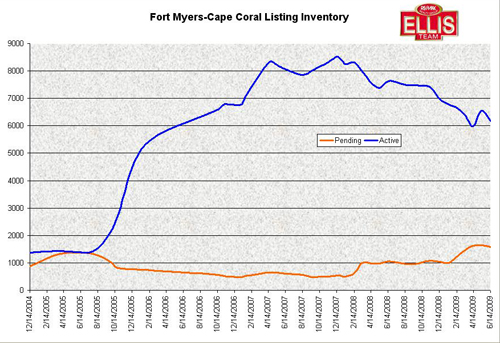

As you can see from the chart which shows Fort Myers and Cape Coral single family

home inventory levels since December, 2004, inventory began rising in the 3rd Qtr of

2005, which was a precursor of what was to come. The overall Lee County graph looks

similar, only larger numbers. Because new construction contracts were still in effect and

building was in its height at that time, the public really didn’t understand what was about

to happen. Simultaneous to the rising inventory levels, you can see that pending sales

started to drop off as well. Combine that with the flood of new construction homes that

continued to flood the market, and you can see very quickly what was about to happen.

Having this information in real-time back in 2005 would have saved some investors some

money.

Fast forward to the 1st Qtr 2008. As you can see, pending sales started to increase, and

listing inventory started to decrease. All the foreclosures entering market were quickly

absorbed, and then some. 2008 4th Qtr sales were close to an all-time record, and 1st Qtr

2009 was an all-time record. In fact, we’re seeing more sales now than we saw at the

height of the Boom back in 2005. So why isn’t everyone reporting this as the Boom?

2005 was filled with euphoria, rising prices, banks lending money like drunken sailors,

and just generally reckless abandon. People just didn’t think it would end. They ignored

the warning signs. The market was not sustainable, but just try telling that at a cocktail

party with 6 of your closest friends who were flipping houses and making money.

Nobody wanted it to end, and yet it could not continue. It was phantom demand, and

over-supply.

Today we have more sales than the Boom, but consumer confidence is low,

unemployment is high, oil is still high compared to 2005, and home sale prices are low.

Homeowners are having a hard time making payments as incomes are down, and few

people feel great about their financial matters. This is why nobody is calling 2009 a

Boom, and perhaps they should. The opportunities for a buyer today are far greater than

they ever were in 2005. 2005 was a false market as nothing was what it appeared.

Today’s market is real, and the bargains are there. In fact, sale prices are so far below

replacement cost there is no building inventory entering the market in the foreseeable

future.

When the job market and the economy begin to recover, we may actually have difficulty

finding properties for buyers. The builders have not been building, and many sellers

cannot afford to sell at today’s prices. Banks have been forced to “short-sale” or

foreclose, and the foreclosures may start drying up by next year. Some speculate there is

another wave coming due to resets in the ARM schedules in 2011; however we feel that

in SW Florida, most of those buyers have already walked because they were the

speculators who long ago realized they could never make a profit, so they chose not to

carry the costs. If all this is true, we may have a period of diminishing inventory to sell

until the market sorts it out.

Many Realtors who study the market were sounding the warning signs back in 2005, and

yet the public didn’t get the message. Many of those same Realtors are recognizing that

2009 is a Boom, and yet not all of the public is getting that message either for reasons

outlined above.

Our goal is to provide you with meaningful data so that you can see what is really

happening in today’s market. These first several weeks we’ll be providing a baseline of

where we’ve been and how that relates to where we’re headed. We seek to provide

unbiased insight you might not have received anywhere else. We seek to make sense of

what’s happening, and prove it with facts. We can say that home sales have exploded

since 2008, and listing inventory is declining. We’ll watch this market together, and

we’ll do our best to explain what’s happening. We’re not tied to the outcome, as markets

go up and they go down. Our job is to explain what it’s doing today, and offer our

insights as to where it may be going in the future, so you can make informed decisions.

Remember, all real estate is local, even in SW Florida. Just because we report something

is going on in the Cape or Fort Myers doesn’t necessarily mean the entire market is

affected the exact same way.

We are seeing a shift from Cape Coral, which has been on fire, over to Lehigh Acres, as

Lehigh is the affordable hot spot right now. It’s the same shift we saw in the height when

prices in the Cape got carried away and buyers shifted to Lehigh. Funny how life repeats

itself. Stay tuned each week and we’ll present more insights.