Each January everyone seems to ask what the new year will bring to the SW Florida real estate market. While nobody has a crystal ball, experience and detailed analysis lends clues to what the future may hold. Each year we release our annual State of the Market Report, which consists of the most detailed and current market stats around combined with our 20+ years of experience in the local real estate market.

We pull these stats in January after agents have a chance to enter all their year-end transactions. We pull from a variety of MLS databases then merge the data together and eliminate duplication of data. Some listings are input and marketed to Realtors in multiple Boards, and we want the most current but accurate data free of duplication. This all takes time, and then the real analysis can begin.

Fortunately we do provide a significant amount of data all year round to our readers and viewers of the weekly Future of Real Estate Video Show, so we can offer some preliminary data combined with experience and make some educated guesses as to what 2010 might bring.

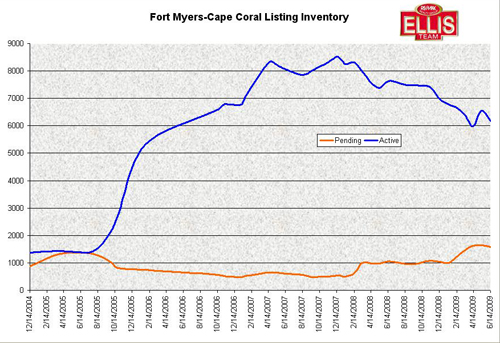

As you can see from the attached graph, listing inventory has been rising recently, and pending sales have started to fall again. We think this may be due to the anticipated expiration of the home buyer tax credit at the end of last November, but that has recently been extended and expanded into 2010. Not only can first time home buyers take advantage of this credit up to $8,000, now people who currently own a home and plan to but a new primary residence can also take advantage up to $6,500. Contracts must be in place by April 30, 2010 and must close by July 3, 2010.

Add to this that our Northern friends are now here, and they are searching for homes. Word has gotten around up North that Florida is on sale, and prices have begun to rise in some sectors, especially the bargain buys. The Snow Birds realize 2010 may be the last “Season” to get these bargain basement prices, so they’re bringing their checkbooks looking to purchase. We wouldn’t be surprised to see pending sales rise in the next few months and inventory to fall again as Northerners help scoop up even more of our inventory. Investors have been hard at work in 2009 competing with first time home buyers, and we believe Northerners will be buying 2nd homes that they may one day move into, or vacation to at the least.

The US Treasury Department has just issued new short sale guidelines which may make it easier to get short sales through for primary homeowners who are in trouble. This may help add sellable homes to the market, which could help increase sales and relieve some of the strain on foreclosures.

Speaking of foreclosures, we believe much of the entry level speculation inventory is now gone, and we expect higher priced inventory to enter the market, which will make 2nd homes and move-up homes more attractive. As this occurs, look for more sales in the higher than median price range, which currently stands around $95,000. These new bargains at the higher price levels will help raise the median sale price.

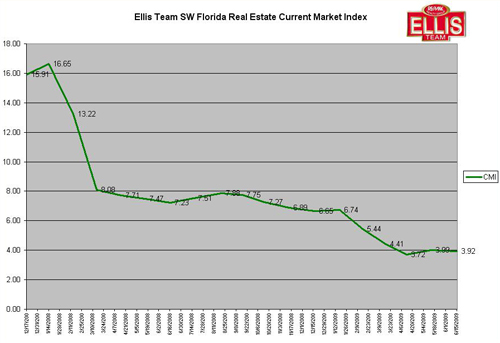

Speaking of sales prices, we’ve seen 5 straight months of median price gains, and we look for that to continue. In fact, early on in 2010 we may start to see year over year price gains, something we haven’t seen in about 4 years. In other words, February or March of 2010 may see higher prices than February or March of 2009. We can’t state the actual month it will occur, however if you study the graphs and data you can see that day looks like it’s coming fairly soon.

Tune in to our weekly video show “The Future of Real Estate” at www.Topagent.com and stay tuned for our upcoming State of the Market Report which we’ll be releasing soon which will detail which areas of the county are moving, changes in averages sales prices, single family homes and condo data, and so much more. We’ll even break it down by zip code and graph it out so you can see how your area is doing, and what the future may hold. Stay tuned.