Yesterday Brett Ellis of the Ellis TEAM at RE/MAX delivered the SW Florida State of the Market Report to the public. The report is 77 pages and includes data on Lee County Florida home sales, including Cape Coral real estate sales numbers, Fort Myers real estate sales numbers and pricing trends, Bonita Spring real estate updates, Estero, Lehigh Acres, Fort Myers Beach, Sanibel and Captiva, Pine Island, and all of Lee Couny.

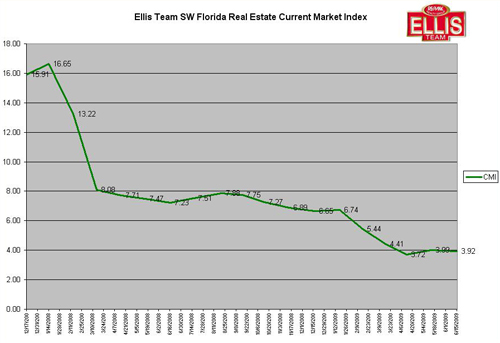

The report shows single family home inventory in Lee County Florida declined 15.61%, and months supply of inventory in Lee County declined 42.66% due to decreasing inventory and increasing sales.

Cape Coral is the hot spot for sales activity, with 4,633 sales and less than a 1 yr supply of inventory. Lee County overall inventory level stands at 17.53 months, down from 30.57 last year. Median single family home sale prices were down 37.89%. Two areas actually saw a rise in mean average sales prices in 2008; Bonita Spring-Estero and Central Fort Myers.

The report provides insightful data at the county level, and at the neighborhood level, as well as foreclosure data. The sub-markets we analyzed were Cape Coral North, Cape Coral Central, Cape Coral South, North Fort Myers, Central Fort Myers, SE Fort Myers, SW Fort Myers, Lehigh Acres, East Fort Myers including Alva, Bonita-Estero, Pine Island, Fort Myers Beach, and Sanibel and Captiva Islands. We provide data such as monthly pricing graphs for 2008, monthly sales charts, List price to sales price ratios, months supply of inventory levels, total list and sales volume,Minimum listing, maximum listing, lowest sold listing, highest sold listing, median price, average price, and total sales.

It is our most detailed report yet. We scrutinized the data from multiple MLS boards and eliminated duplicates. This one of a kind database is more thorough and accurate than services such as MLS Alliance because some boards pull their data out of the Alliance. Additionally, we scrubbed the data for known errors. We allowed duplicates when there were actually multiple sales on the same property for the same year.

73% of foreclosures in SW Florida were non-homestaeded property, meaning investors walked from their investments when the value fell below what they owed. Most investors were planning to flip for a profit when they purchased. SW Florida bank foreclosures were absorbed and sold, and inventory fell as the market heated up, even if prices have not.

We’ll add video of news stories from the report in coming days.

Like this:

Like Loading...