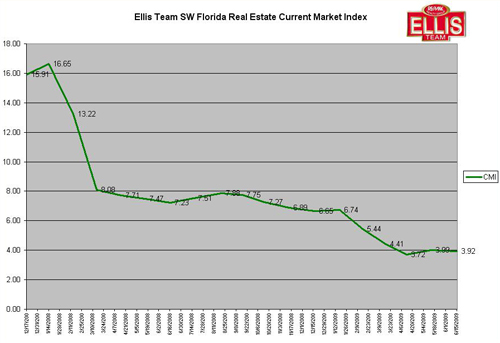

About 8 years ago the Ellis Team created a market index that accurately predicts the SW Florida real estate market. It helped us in 2005 warn the public that the local real estate market was about to turn. Later in the fourth quarter and on into 2006 people began to realize the train had run out of steam. We named it the Ellis Team SW Florida Current Market Index. Since unveiling this index, the National Association of realtors came out with a similiar index called the NAR Pending Home Sales Index, which also predicts future closing activity, but it doesn’t measure the overall health of the market.

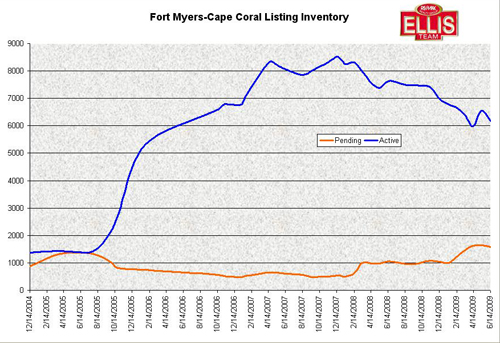

Our local index measures pending sales, but also takes into account listing inventory and measures the overall health of one against the other. It tells us if properties are moving relative to overall supply. This is important because in a good market, it may actually be more of a seller’s market than people realize. In a hot market, sales are held back by the supply, meaning if there were more supply, chances are, there would have been more sales.

The CMI Index numbers peaked out in January of 2008, and back then we started telling the public sales were about to pick up and inventory would start declining. Sure enough, that’s exactly what happened throughout 2008 and into 2009. Our Index was at it’s lowest in April of 2005 and at it’s highest in January of 2008. The higher the index number, the more of a buyer’s market it is and the lower the number, the more of a seller’s market we have. Back in July of 2005, the overall Lee County Index stood at only 1.07. As we know all too well, that was about to change drastically. The numbers shot up to 2.11 by September 2005, and 3.44 by October.

So what do the numbers tell us today? Our index hit 3.72 in April and stands at 3.80 in July of 2009. This tells us inventory levels have been decreasing as predicted and pending sales have been increasing, as predicted. In fact, last month we sounded the alarm that June sales could reach record levels, and they did. July’s numbers when released should be strong as well. Don’t confuse this with rising prices just yet. The market is strong in sales volume, but we’re in a new market that has reset, and prices aren’t going back to 2005 levels. We are starting all over from scratch and 2009 is the new baseline, and as the market heals, the baseline will have room for future price appreciation, with moderation.

We update this graph each month on our Blog, blog.topagent.com and we look forward to providing this insight to News Press readers in the months to come. Its one thing to have a Feeling about what the market is doing, however really studying the actual facts and charting trends helps to better understand what the market is actually doing, and where it may be headed. Nobody can know with absolute certainty what will happen in the future, so we look to statistics to give us our best guidance. Statistics are our radar so to speak.

We really try to look at the data with an unbiased eye, meaning we’ll let the data speak for itself and tell the story, as opposed to hypothesizing what the story should be and trying to prove it. We’ve been right, and we’ve been wrong, and the point is we’re not attached to the outcome of our predictions. We simply lay it out there and let you decide based upon the best facts we have at the time.

We’ll be running a new batch of numbers soon, but the July Index appears to show a strong market going forward for the next few months. It looks like July and August sales numbers should be in good, and we look forward to the release of official numbers on August 21. We won’t be surprised if July’s numbers are big, perhaps up as much as 100% or so, but down slightly from June’s record numbers.