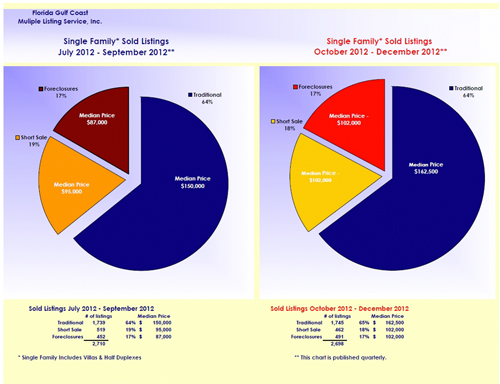

Shakira’s hips don’t lie but can we say the same for the SW Florida real estate market numbers? Actually the Association of Realtors hasn’t released official numbers so agents like us are left to report our own numbers based upon predefined searches.

3 Weeks ago we asked the question “Where Are The Listings?” MLS shows an increase in listings but we weren’t seeing it on the street. Our team is down to 13 listings. We have more pending and closed than we do actual listings. We keep hearing on the street inventory is down and it’s hard to find properties to show buyers, so we decided to search MLS for ourselves and report the counts.

We’re wondering if the MLS changed classification on certain listings because in January the numbers shot up. As a property goes pending it comes out of active inventory, and we’ve been putting a lot of properties pending in the past 3-4 weeks. Is it possible more listings are coming on the market than coming off? We think that’s doubtful.

I’ve been in contact with the association to get official numbers and the answer I get is they are not being released as usual until the Board meets. We compile numbers from various MLS systems and each time an MLS changes vendors it creates havoc as the data sharing policies and technologies need to be tweaked.

Cape Coral and Bonita Springs recently selected a different vendor than Fort Myers so this could be causing a delay in releasing numbers. It can also alter the data drastically. Even if data is shared there can be duplicate data as the same home can be input into two or more MLS’s. I always hate MLS changeovers more than most agents because we do compile data and it forces us to not only search multiple MLS’ like an agent does, but forces us to compile and make decisions about duplicates.

We like to report apples and apples and that is always hard when a changeover occurs. It forces us to restate new baselines in the data and move forward from there. In a perfect world all MLS systems would share data and use the same vendor, but we don’t live in a perfect world.

For the time being these numbers are the best we’ve got, and we’re skeptical inventory is rising. Our personal listing inventory is selling quickly this season and shrinking. If a home is marketed properly and priced correctly, it should sell. We have more buyers here now than we will any other time of the year. If a home doesn’t sell now, it may not sell at the same price the rest of the year. Of course, there is one caveat. We are in a rising price market, so if you’re over priced today, eventually the market may catch up to your price. Of course, with Sequestration, looming government shutdowns and a national debt crisis, nobody knows what the future will bring exactly.

Our advice is if you want to sell today, market it and price it at today’s market. If you wait for something that may or may not occur in the future, you run the risk of being disappointed, and with Congress and the President today, there’s a pretty good chance they’ll disappoint nearly everybody in the coming weeks and months.

If you have a property to sell, please call us. We know how to market, and our properties are selling. We’ve got about a month left for high season, so there’s still time to maximize buyers for your home. If you’re a buyer and you see a home you like, jump on it because even though the numbers say inventory is up, we’re not seeing that on the street.