Interest rates have been rising, and we expect they could rise further. The primary reason is the Fed has indicated it will raise rates by scaling back or ending the quantitative easing as the economy improves. We’re not there yet, but writing from the Fed is on the wall and it’s spooked the bond markets. What Do Buyers and Sellers need to Know Now About Rising Interest Rates?

Interest rates have been rising, and we expect they could rise further. The primary reason is the Fed has indicated it will raise rates by scaling back or ending the quantitative easing as the economy improves. We’re not there yet, but writing from the Fed is on the wall and it’s spooked the bond markets. What Do Buyers and Sellers need to Know Now About Rising Interest Rates?

30 year mortgage rates have risen over 1% in the past 7 weeks. You’ve probably heard Realtors say “Now is a great time to buy with rates so low.” Here’s what you need to know about rising rates as a buyer or a seller.

Buyers, in the past month or two you just lost about 10% purchasing power. Your income won’t buy as much as it did back in May. Did you get a 10% raise this year? Most people didn’t, but the cost of buying a home is going up.

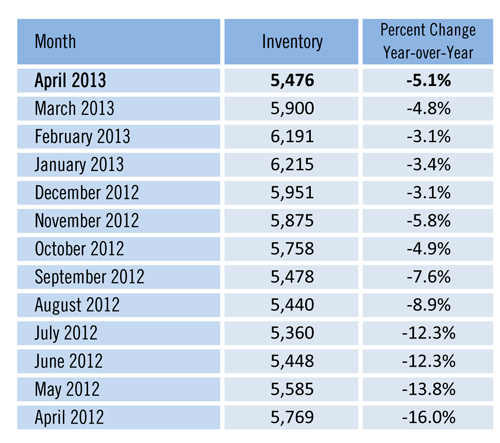

For most buyers the increase in rates means they’ll have to buy less home. Their income didn’t go up, so they either have to put more money down or borrow less on the same income. This isn’t a pleasing thought to many homebuyers as inventory levels have been low and prices have risen about 20% over last year. Buyers are getting squeezed at both ends, and rates may get worse.

If you’re living in an apartment or renting a home, now may be a time to get serious about your options. Prices usually stagnate this time of year. See last week’s article. However, SW Florida is adding two new companies with employees who will either be looking to rent or buy, so this will add to the pressure on the inventory. Who knows how this will affect prices. There are several variables in play for our local market.

Construction has been picking up to help with the shortage of resale homes but that takes time. Waiting to buy a home in today’s market has cost buyers dearly. They either have to pony up more money or accept that they’ll have to sacrifice the location they desire or features in the home. Of course, expectations are all relative. A buyer will afford less than a few months ago, but considerably more than back in 2005, so it’s all relative.

Sellers, don’t get too confident here either. Yes, prices have been rising, but they typically do during season. See last week’s article (June SW Florida Real Estate Market Update), or visit our Blog at http://blog.topagent.com

Buyers have just lost 10% purchasing power. Even though we have low inventory levels this means that fewer buyers now qualify for your home. They may still qualify, but for lesser homes. If rising rates knock enough buyers down the ladder it can affect the market. Our market has been doing well the past few years and prices have risen. We’ve had low rates the entire time and now that rates are rising, it will damper further increases. Until we get this economy humming like it should there is a cap to how fast prices will climb.

Nobody knows the future on the speed of prices. We do know 2 companies are coming, and many up North are buying for retirement or enjoyment. We also know rates are rising. How these positive and negative forces counter balance each other will be interesting to watch.

Our advice would be: Buyers, get your ducks in order and call us soon. Even if prices stay where they are for awhile, rising rates will hurt you.

Sellers, don’t get too cocky. Rising rates will hurt buyers, and if it hurts buyers, it could eventually hurt you as the seller. Plus, if you’re selling and buying another home, waiting to sell could cost you if you’ll be getting a mortgage on your next home.

If you’re thinking about your options, it would probably pay to sit down with us and discuss it. This is one of those times when waiting to see what happens may cost you. Or feel free to search the MLS at www.Topagent.com to see what’s out there.

Good luck and happy buying/selling!!!

Visit our Google+ Business Page