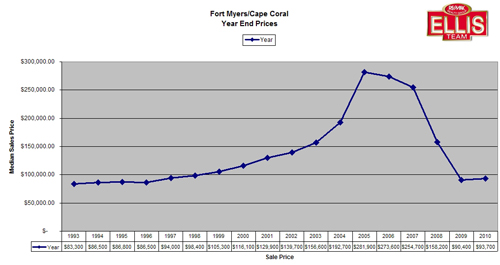

Official sales numbers were released both nationally and at the statewide level, and the good news is SW Florida’s real estate median prices rose 3.65% from $90,400 in 2009 to $93,700 in 2010.

Does this mean we’ve experienced the bottom and on our way up? The answer is possibly, as foreclosure sales have fallen and prices have risen in the lower end of the market. As this lower end of the market rises, which comprises a large part of the Lee County home sales, it automatically drives the median price up.

Higher priced homes could actually be falling and also raise the media price up. You might ask yourself, how could this be? A Median price simply means that half the homes sold over a certain price point and half under. So in 2010 half the single family homes sold at or below $90,400 and the other half sold at or above this number.

For the sake of illustration, let’s say 20 homes sold in a given month at $400,000. Now let’s reduce all the $400,000 homes down to $300,000. Do you think more would sell? Of course they would. So now let’s imagine the new bargains at $300,000 generated 60 sales instead of the previous 20. This could pull the median up from $90,400 to perhaps 93,000.

I know this example is hypothetical. We also know there are less and less $50,000 homes, so as there are less home sales at the bottom end, and more above the median, the median price gets pulled from the top end and pushed up from the bottom. It is not however a great indicator of what could be happening at all price points.

We’re not saying the $400,000 market is still falling, although it could be. What we know for sure is the bottom has firmed up. It feels like anything priced correctly today at $150,000 or less is firm. Priced correctly is the key term. Homes priced at $200,000 today were priced much higher several years ago, and we are noticing these homes selling too. In fact, we believe this season will produce more sales $150,000-$300,000 than we’ve seen the last several years.

Northerners are just plain tired of the awful weather up north, and they realize home prices are great deals now and they’re becoming increasingly afraid they may miss out on the bargains.

Speaking of inclement weather, this past week we had several buyers place offers from up North and they commented they just couldn’t take it anymore. Several agents I’ve spoken with shared similar stories, so the bad weather up North may be good for business down here.

As you can see by the graph, SW Florida home prices are at 1997 levels. This sure is a steep curve on the downside but the worst may be over. We believe there will be more foreclosures, but it feels like we’re at about the 7th inning. Most of the investors have already lost their homes, and now we’re down to average people who have lost a job, or lost household income and cannot afford the payments, and they just cannot sell at today’s prices. How much more of these we see will depend on the national economy and how long the recession persists. Uncertainty in the Middle East and oil prices will be a wild card, so let’s all hope for Egypt, Tunisia, Jordan, and anywhere else to remain calm and shipping lanes open.

Banks look like they’re bulking up to increase short sale business, although we’ve heard the talk before. We can say Bank of America has been much better to deal with recently and we’ve gotten several short sales approved and closed. It would be nice if other banks sped up their processes too.

Inventories actually rose in December despite an increase in distressed closings due to backlogs. We expect this inventory could go down; however we believe there is much shadow inventory. Many refer to banks holding back properties from the market as shadow inventory, but the shadow we’re referring to is regular homeowners who would put their home on the market if they could, but they just can’t because they owe too much and can make the payments. There is now way to measure this, but typically most in SW Florida would move around every 3-5 years, and people just haven’t been doing that these past five years. The reason: See Graph.

We’ll be coming out with a new SW Florida Real Estate Video update, but until then you can view our December 2010 Video Update.