Take a good look at the graph. Headlines next week when official numbers are released may report that sales were down versus December numbers, and this would be true. However, preliminary sales numbers we track indicate January 2011 sales mirror very closely January 2010 sales, and pending sales are on the rise again. Last year’s graph showed rising sales peaking in March and holding fairly steady through June. This seems entirely plausible as Southwest Florida typically experiences seasonality in the market, and the pending sales bear witness to potential closings going forward.

Pending sales countywide in February aren’t quite at 2010 levels but they’re close. Currently we have 2,704 pending sales in the Greater Fort Myers and Bonita-Estero Association of Realtors MLS compared to 2,758. Pending sales in just Fort Myers and Cape Coral are off a little bit more, but in any event we expect to see rising closing numbers as we go through season.

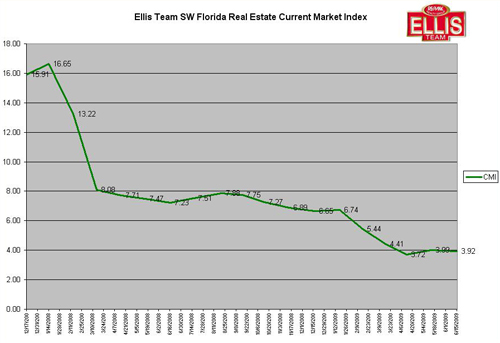

In fact, our Current Market Index now stands at 4.18, down from 4.66 last month. We developed this index to measure pending sales activity against inventory levels to determine strength or weakness in the market. In years past, sometimes sales were down simply because there were few homes on the market, not because the buyers weren’t ready willing and able. We account for this in our index.

Listing inventory is down slightly in both single family homes and condominiums. Prices last month rose about 3% and we wouldn’t be surprised to see them rise again, although we didn’t specifically study prices for this report. As foreclosure sales fell 12.50% this past month, it’s natural to assume less low end homes sold which would help push the median price up. Additionally, short sales fell 7.45%

Banks have pulled many foreclosures from the docket until they have more time to check their paperwork; Most of these homes will eventually come back to the market. In a perfect world we’d like to see the banks increase their efforts in selling via short sale. Citi Mortgage and Bank of America have done this and are promising faster turnaround times. We have noticed a distinct difference in the turnaround times at Bank of America and Citi has a new program rolling out now.

We’re keeping an eye on some interesting trends. Lehigh Acres distressed sales are continuing to rise to 73.85% of all Lehigh sales, while Fort Myers remained steady at 56.64%, down slightly from 57.19% the previous month. Cape Coral distressed sales were at 66.27% in January, up from 61.13% in December.

We expect Season to be very strong again this year. The national economy is picking up a bit. It will be interesting to see how the economy, interest rates, and bank owned inventory affects the market in the 2nd half of 2011. The first half’s course is pretty well set.