It’s been over a month since we reported on single family home sale prices in Lee County, so we thought we’d provide an update. Many people are questioning prices right now as tax notices went out recently, and many have been shocked at some of the new value assessments imposed by the Lee County property appraiser’s office.

Keep in mind that value assessments from the property appraiser’s office reflect values as of January 1, 2010 and not today’s values. Its possible values have risen or fallen since January 1 depending on where you live. Values do not move in tandem in perfect harmony. Certain sectors of the market lead others, and when one moves another will follow to keep from having too much disparity.

I could devote a whole article to this phenomenon we call “bunching” but we’ll save that for another day. Since January, we’ve seen countywide price increases through April where median home sale prices peaked at $101,500. Median sales price by definition means half the sales occur below that price and half occur over that price. Median sale prices have fallen since April to $93,500 which you can see by the chart. New sales numbers are scheduled to be released September 24 which was after this article was written, so we’ll be keeping a close eye on sale prices and closed sales volume.

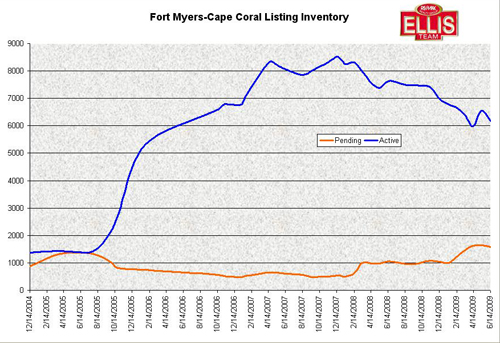

We did see an increase in pending sales last month which is a good sign going forward for closed sales, but pending sales were down about 19% from last August, and about the same for September, so official September sales would not surprise us if they came in down from last year.

Nationally unemployment is at 9.6% and the housing market is stalled, which does affect the SW Florida real estate market to some degree as northerners may be putting off selling in tougher times and moving to Florida. Additionally, unemployment is a whopping 13.7% here in Lee County and rising, which does not help demand for housing, especially in the $150,000-$400,000 range. The bottom of the market has indeed firmed up and homes listed below $100,000 are often scooped up quickly with multiple offers. Homes priced much higher take longer as investors cannot flip them, the rents don’t always cash flow, and there aren’t enough 2nd home buyers to pick up that slack.

Season will be approaching again soon, and last year our northern friends did buy. We’ll keep an eye out and see if that trend continues this year, and it very well could because the $150,000-$400,000 homes are still bargain buys, and everybody loves a bargain.

We’ll also report on pending sales in a few weeks. Our guest on our Internet TV show will be Lee County property appraiser Ken Wilkinson. We plan to ask him about housing values, and how to read the 3 columns in the trim notice to determine where your taxes will be for this year when tax bills are due in November. The show is posted at Topagent.com

Interview wih Lee County Property Apprasier Ken Wilksinon