Lee County median sales prices declined $10,500 in March 2023 from February. This is significant because median home prices generally increase throughout the season. We have been reporting for months that home prices dropped in 2022 but nobody realized it because most people focus on year over year numbers.

Year-over-year median prices were up 1.9% in March. The median sales price this year stands at $437,000. Last march it was $429,000. In February of this year the median price was $447,500. Looking forward, the official number for April 2022 was $470,000. If the median sales price doesn’t climb to $470,000, we’ll be reporting the first year-over-year loss in a while. About 6 months ago we predicted we would see this drop with the April or May numbers.

Preliminary April Numbers

One thing that could change Lee County median sales prices that is if April sales numbers come in higher. Preliminary numbers reported through April 25th when this article was written suggest numbers of $445,000. This number will be off because there are some closings that haven’t been reported yet, and some closings that haven’t taken place yet.

The end of the month always includes several sales. If the $445,000 number holds up. It would be a 5.32% drop.

Why Studying the Market Matters

We study the market to give our clients an advantage. For instance, years ago when we saw our Current Market Index turn negative, we got all our sellers out before the big price decreases. It’s never fun to be caught chasing the market down. When the market is moving upward, it is important for buyers to get in there quickly and beat out other buyers to hot new listings. Waiting literally costs the buyers money.

Predictions

We are not making predictions about the market here. We’ll save that for our clients. We are simply reporting what we are seeing. The predictions about when we would see negative numbers weren’t really a prediction about the market. That was more of a mathematical equation that was going to reveal itself in the future, and the future is almost here.

We believe home sellers are going to be just fine moving forward. Sellers must price their home correctly and market it correctly and success will follow. Today’s Current Market Index is stable, so we don’t see large price fluctuations anytime soon, unless market conditions change.

We do have the possibility of lower interest rates on the horizon as the economy slows down. Lower rates help borrowers afford more, which could lead to higher prices in the future. A declining economy may weigh against that as more buyers lose their jobs.

X-Factor

The X factor will be how many people continue to relocate to Florida who do not need a job to purchase or have a job that will allow them to relocate. Those remote jobs are drying up as more employers require their workers to show up in person, but there are still some out there.

The true answer is nobody knows what the future of real estate prices will be in SW Florida. We are watching all the indicators driving values and on balance they appear to be neutral. If you have a property you’re considering selling, call Brett or Sande Ellis at 239-310-6500. We will be happy to guide you through your home’s value and what improvements if any would be most beneficial for your sale.

You can always visit www.SWFLhomevalues.com to get a Free Instant home value of your home. We think it’s kind of cool to track that value over time, which the system will do for you.

If you have your eye on a property but are not quite sure how to pull it off because you have a property you would need to sell, we should talk. We are experts at making things happen, and we have some creative financing options you might not know about that can help.

Good luck and Happy House Hunting!

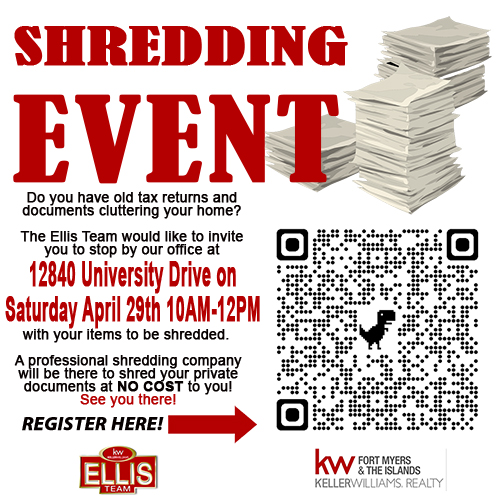

Free Shred Event Saturday April 29th 10 AM- 12-PM

3 Bed 2 Bath $350,000