According to a report by Up For Growth, the US housing production deficit increased to 3.79 million units in 2019, up from 1.65 million units in 2012. This means that we as a nation are not building enough housing to keep up with demand.

This is not good news for renters, or home buyers. Prices are rising due to lack of supply at the same time interest rates are rising to quell demand. How do you quell housing demand? People need a place to live in. Rising rates makes it harder for builders to build and sell at a profit, so they slow down or stop building, which exacerbates the problem.

Housing Production Deficit Increased

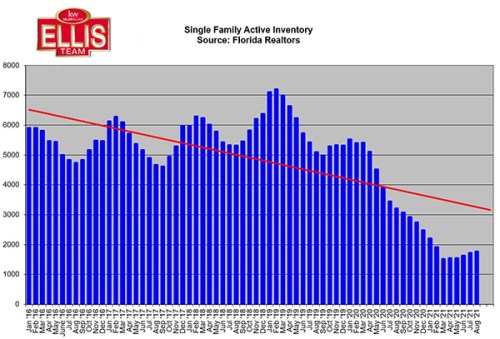

We have a map put out by Up For growth which shows state by state the amount of underproduction in 2019. Reasons vary by locale why. For instance, in Detroit, many homes are uninhabitable according to the report and they need new homes to replace them. Florida is a different story, as more and more people are moving to Florida and supply isn’t keeping up with demand.

Housing is a complex issue, and their report is 76 pages long addressing the issue. Suffice it to say, we need more housing, but the situation is only getting worse.

Should I Wait For Prices to Drop?

Many potential home buyers do not like their choices. Some will decide to rent another year in hopes home prices will come down. This may not benefit them the way they think. Even if home prices declined 5-10%, their payment would still rise more than the price savings due to higher interest rates that may be coming. Waiting in this scenario can cost them.

Secondly, a year from now they may be worse off. While faced with the same decision next year, rents may be higher, because people need a place to live in while supply is not keeping up with demand. Never mind if everyone can afford it, enough people can which drives up the rents.

Additionally, while rents may go up, the potential risks don’t end there. The landlord may decide to sell the home before your lease is up, or simply not renew your lease. Remember, it is a lease. You do not own it. He or she that owns the property gets to make all the decisions, not the tenant.

Inflation Raises Future Costs to Build

Lastly, as inflation lingers, the cost to build a home in the future only goes up. Future supply will cost more. Home buyers can get on the equity train now even though the home costs more than it did a few years ago. Yes, interest rates are higher too, but you can’t go back and change time. You can refinance later if rates go down in the future, but the cost of the home probably isn’t going down. In real estate you marry the house and date the rate. Inflation is one of the reasons.

Inflation compounds as well. Each year the cost to construct new homes builds on the previous year’s costs. Over time, a $500,000 home today may cost substantially more to build later. Renters might be well served to get on the equity train sooner. Most tenants do not purchase because they are worried about their job, home prices, interest rates, down payment, repair costs, etc. The truth is all these same worries will be there in 1 year, 2 years, etc. The sooner you act, the sooner you get on the train. If you lose your job, it will not matter if you are a renter or homeowner. The landlord will still kick you out if you do not pay rent.

You can search the MLS like a pro at www.LeeCountyOnline.com, or call one of our buyer specialists at 239-489-4042. Don’t forget about our Hurricane Party Prize Package. Deadline to enter is midnight July 25th. Simply go to www.Topagent.com to register to win this package.

Good luck, and Happy House Hunting!

Win our Hurricane Party Prize Package

New Ellis Team Featured Listings

11530 Timberline Cir

12157 Lucca St Fort Myers FL

Open House Sat 12-3 PM

To mimic the success home sellers are having through their Realtor, several home builders have instituted a highest and best offer format on their homes. Basically, it works like this. The buyer makes a binding offer on a lot. There is typically a stated priced however the buyer can offer highest and best. The winning bidder chooses the home they want built and they go to contract.

To mimic the success home sellers are having through their Realtor, several home builders have instituted a highest and best offer format on their homes. Basically, it works like this. The buyer makes a binding offer on a lot. There is typically a stated priced however the buyer can offer highest and best. The winning bidder chooses the home they want built and they go to contract.