We are writing this article the morning after the election. At this time, it is unclear who the next president of the United States will be or when we will know. What we do know are the real estate statistics pre-election. Today we decided to focus on pre-election dollar volume for the SW Florida real estate market.

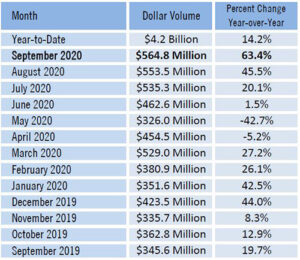

Pre-election dollar volume measures the total dollar volume of sales in a defined time period. We calculate this by adding up all the sales volume in each month. September 2020 SW Florida saw $564.8 million dollars in total dollar volume. That is a whopping 63.4% increase over 2019 numbers which were $345.6 million.

Pre-Election Dollar Volume up in Summer

Pre-election dollar volume started taking off back in June. Keep in mind we have been in the middle of a pandemic and we are still eclipsing 2019 numbers. 2019 is the benchmark, and we know that was a good year in real estate in SW Florida. June was only up 1.5%, but it started a trend we will look back on as a defining moment. July posted a 20.1% increase in pre-election dollar volume in real estate sales. Along came August which blew June and July away. People thought the market could not get any stronger, and September would prove them wrong.

New pending sales in September are 58.2% higher than 2019. We know you must have a pending listing before you can have a closed sale. New pending sales are a leading indicator of what may happen 1-2 months down the line. Because many home loans are taking a minimum of 45 days to close, many of the September new pending sales will close in December. August new pending sales were up 42.4%, so we believe October official numbers when released will show increases as well.

We may not see a rise of 63.4% like we saw in September, but October numbers should rise compared to 2019. We have seen excellent demand. One thing that could limit sales would be limited supply. The other factors that will influence the market going forward is how people feel about the eventual winner, and the makeup of congress.

Will economic policies spur growth? How will northern states react to the winner, and will they continue moving to Florida? Will that pace speed up or slow down? How many people will decide to list their home post-election? All these factors will play a role in the total dollar volume moving forward into 2021.

Waiting on a Winner

Once a presidential winner is determined, it may take people awhile to digest how they feel about it and how future economic, social, and tax policies will affect homeowners. This may vary by state and county. We have seen a migration away from high tax states to low tax states. We do not know if other factors will come into play post-election.

It would be impossible for anyone to predict how the SW Florida real estate market will fare going forward. Heck, as of today writing this article we cannot even tell you who the president will be or who will control congress. We can report that pre-election dollar volume was excellent in SW Florida and on the rise. It should remain great for another few months. Other indicators have been excellent as well. Right now, SW Florida has an exceptionally good real estate market.

If you would like to talk about selling your home, please call Sande or Brett Ellis 239-489-4042 Ext 4. We can discuss your options, how the overall market is doing today as well as your neighborhood and put a game plan together for you should you decide to sell. Or, you can always get an instant value of your home at www.SWFLhomevalues.com It’s instant and easy. We can validate the online price in person if you are considering selling. Your choice.

Always call Sande or Brett Ellis at the Ellis Team Keller Williams Realty! We’re never too busy to talk to you. Good luck and Happy Selling!

Ellis Team Weekend Open Houses

Saturday Nov 7th 12-2 PM

Sunday 1-4 PM