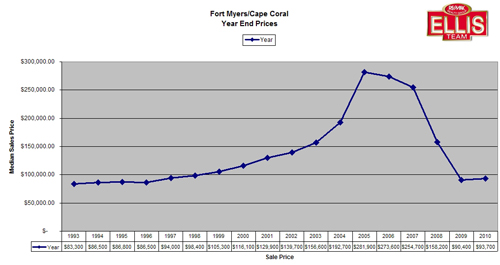

When the headlines come out in a few weeks experts will be talking about how sales prices are up over last year’s numbers, and that would be true. At the Ellis Team we like to study the market and identify trends for our customers, and today we’ll pass that along to you. Fort Myers Real Estate Prices and Cape Coral Looking Flat.

We first reported some possible trends we’d be keeping an eye on back on Feb 26th in a blog post Are SW Florida Real Estate Sales in Trouble?

Again last week we wrote about some subtle changes we’re seeing in the market. Listing Inventory Rises Slightly in February, Sales Increase- Is the SW Florida Real Estate Market Changing?

Today we’d like to talk about some pricing trends we’re seeing. I pulled up March 2014 sales data the morning of April 1. Keep in mind it takes many days for some agents to input closings into MLS after they close at the end of the month. Not sure why, but it’s been a reality for years. Based upon preliminary numbers we’re seeing, median price for closed single family homes in Lee County Florida remains at $185,000. This is the same number as officially reported in February. In other words, median prices did not increase in March.

Fort Myers Real Estate Prices and Cape Coral Looking Flat

Average sale prices came in at $265,386 in March, down from February’s $311,536. While both numbers are higher than March 2013, they are the same or lower than February 2014. So what does this tell us?

It tells us experts will be telling us how much better the market is this year because prices are up over last year, but it doesn’t give us perspective. Typically prices begin an upward trend in February culminating around April-May, and sometimes June. This year we’re not seeing that.

Season tends to set the trend for the rest of the year. For the past several years we’d see our big price gains during season then the market would ride the train for the rest of the year, typically with prices dipping back down a bit after season until the following season.

If preliminary numbers for March pan out, we appear to be flat lining at a time when prices normally increase. It’s called seasonality of the market, and we’re not seeing the seasonality. If this trend holds true, our market may have peaked and retrench a bit later this year.

Or, it could be a blip on the radar and mean nothing. I try not to read too much into data until a developing trend emerges. I do like to inform readers and agents as to some of the trends I’m watching.

A good agent shouldn’t be tied to the outcome. Far too often I’ve seen agents make predictions and then choose data that supports their predictions. Right now we’re not predicting anything, just reporting some things we’re keeping an eye on. As a seller, this is information you might want to consider when pricing a home. We do similar analysis at the subdivision level as well, as all real estate is local and just because one area of the county is hot or cold doesn’t mean all subdivisions are at the same rate. Last week we posted a more complete analysis on our YouTube channel with graphs and trends you might find useful. Go to www.Youtube.com/brettellisfl to watch that video.

Where is the market headed? Will it pick up steam or cool off in 2014? Nobody knows the answers, however we will keep you posted every step of the way. Knowledge is power. Not having knowledge can cost you money, both on the buyer and seller end. People think the value of a Realtor lies in their MLS data. Sure, you can search the MLS at www.Topagent.com. That’s not the value of a Realtor though. The true value is a Realtor’s ability to guide you through the tricky real estate maze and help you make the best decisions for you. We take that very seriously as do many full-time Realtors.

Always hire an experienced agent. Finding out the hard way later on can cost you in more ways than you know.

Good luck and Happy House Hunting!

If you’re considering buying or selling in Fort Myers, Cape Coral, Estero, Ft Myers Beach or anywhere in Lee County Florida, give us a call. 239-489-4042 or visit our website www.Topagent.com

Search the MLS

View Larger Map

Feel free to view our Virtual Tours .

Visit our Google+ Business Page