Season felt like it was good but statistically the numbers weren’t coming in like they usually do in the Fort Myers and Cape Coral real estate market. February and March sale prices were flat and this is the time of year they usually rise. We reported that was a trend we wanted to keep an eye on.

Other Factors Influencing the Fort Myers and Cape Coral Real Estate Market:

Another trend we were watching was the weather up North. This past winter was frightful in every aspect and many speculated this would be a boom for SW Florida, including us. The numbers weren’t as strong this season as the weather was dreadful, so some were scratching their heads.

At an Ellis Team meeting a few of our buyer specialists were commenting on how many of our buyers were done with living up North, but the weather was so bad they couldn’t leave. They longed for the day for the weather to improve enough so they could plan a trip down to paradise.

Guess what? Many of them did just that and our sales started rising. The last few days of April and the first week of May were particularly strong, and we haven’t slowed down since. Some of these sales were Northern buyers coming down. Others were local buyers making their move.

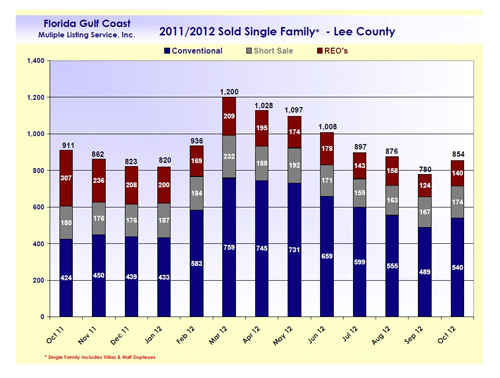

In any event, we’re starting to see the charts move again. It’s too early to tell if this is a trend as closed sales tend to peak in April and May then simmer back down for the rest of the year. The same is true with prices as Northerners snatch up higher priced homes during season.

We are seeing pending sales going up right now on our team. Countywide inventory is going down, so this may bode well for home sales going into June and July. Prices may follow suit, and if this holds true, it bolsters the idea that perhaps 2014 is in for a late season.

Years ago summer was the hottest selling months for single family homes. We might be returning to that model. Of course, years ago the locals freely bought and sold in the summer months when all the tourists went home because they had more time. Many locals work hard during season and things free up a bit when they go home.

For the last 7 years or so locals weren’t able to buy and sell in the summer because they were under water on their home, or their business hadn’t fully recovered yet. Now more and more are able to sell as they finally have equity due to rising prices and paying down their mortgage. Each year going forward we may see more and more eligible locals in the market.

At the Ellis Team at RE/MAX Realty Group we’ve been listing homes and they’ve been selling quickly. This could be a good sign. We’ve been excited to show off our new Hi Definition marketing program and we’ve been having trouble keeping our new listings long enough to video them. We do have some videos coming to the market you can check out at www.HomesinHd.TV

We are seeing increased activity from online leads as well. I just went in and searched our online MLS search site and we had 17 new registrations in the past 2 days, so that’s about 8.5 per day. That’s a healthy number signing up to view homes in MLS so that may be a sign there’s increased interest in the SW Florida real estate market as well. If you’d like to search the MLS, go to Topagent.com

We hope everyone has a happy and safe Memorial Day weekend, and remember Memorial Day is a day to remember US armed forces who died serving our country.

Good luck and Happy House Hunting!

To search the MLS visit TopAgent.com To learn more about Hi Def video for your home visit HomesinHD.TV

Visit our Google+ Business Page

Search the MLS

Search For Homes in Reflection Lakes Fort Myers

View Larger Map

Feel free to view our Virtual Tours .

Fort Myers Real Estate Agent