Aggressive marketing and proper pricing is key in a shifting market, and SW Florida has been in a shifting market since May 2022.

For instance, last January the median percent of original list price received was 100%. In January 2023 that slipped to 95.5% In other words, sellers are accepting less than full price, or being forced to reduce their price before accepting a full-price offer, on average. There are still some full price and above offers going on, but they are occurring much less frequently than last years fast paced market.

We’ve been saying for months year over year pricing will come down starting in about April if nothing changes. Official numbers were just released and the median price versus last year was up 1.6%. The average price was up 1.3%. This tells us the market is flat year over year.

You have to dig deeper to realize that last year’s price runups occurred up until April and May. Prices have since slipped backwards since then, but nobody realizes it because they are focusing on year over year numbers. We like to look at month over month then account for seasonality.

Interesting Numbers

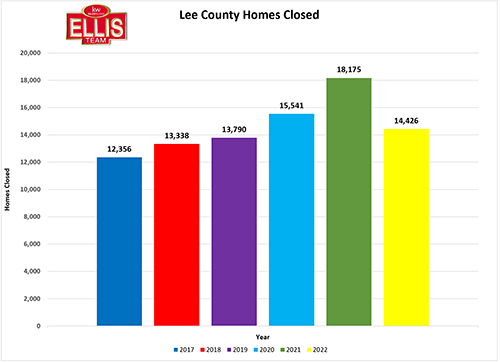

Months supply of inventory is up 220% from last year. Active listings are up 150.7%, and pending inventory is down 28.7% Closed sales are down 21% from last January.

In order to sell today, sellers must know exactly what is going on and price accordingly. Sellers also must list with an agent that is aggressive in marketing as buyers have more choices to choose from than last year. Your home must stand out, and marketing is one way to do that.

Thankfully clients of the Ellis Team at Keller Williams are well informed on the market, and we utilize cutting edge marketing, making our homes stand out. We are also using a new patented system to help our sellers sell faster and for more money than the MLS.

New Tracking Technology

Soon we will be releasing new technology that will track your home’s value over time. If you’d like to get an idea of your home’s online value today, simply go to www.SWFLhomevalues.com and type in your address. The system will email you your home value report. This site is one of the best sites we know of to track your home price. However, we won’t stop there. If you like, we’ll track additional sources and update you over time. Stay tuned for exciting information on this, but you can get started now.

Better Way to Sell than Traditional

If you’re thinking of selling in the next 1-2 years, you can call Sande or Brett Ellis at 239-310-6500. We can show you our patented system that gets our sellers homes sold faster and for more money. 6,440 home sellers that used this program over 2.5 years averaged 8.4%-12% higher prices than their local MLS median price. It can cost you to hire the wrong Realtor!

In a shifting market, knowledge and experience matters more than ever. Brett and Sande Ellis have been through several shifts, so we know that aggressive marketing and proper pricing is key netting you the most money and getting your home sold before all the price reductions.

We look forward to answering your questions. We are not pushy, but we get results. Always call the Ellis Team at Keller Williams with your real estate questions. 239-310-6500

Ellis Team Weekend Open Houses

Open House Saturday 12-3 PM

Bell Tower Park 4 Bedrooms 3 Baths 2 Car Garage

Open House Saturday 12-3 PM

3214-3216 SW 7th Pl, Cape Coral

6 Bedrooms, 4 Baths 2,560 SQ Ft