Lee County Florida real estate cash sales fall 23% in September 2015 and that’s a good thing. We said several years ago one of the signs of a recovering economy is infusion of capital. We’ve been watching a fairly steady decline in cash sales for the past few years. Back in the doldrums of the market reset cash sales accounted for about 70% of all sales.

Investors came in with cash and bought up everything they could at rock-bottom prices. Cash was good because back then banks were nervous about lending. Today banks are encouraged to lend again and prices are nowhere near rock bottom, so buyers have less competition from flippers and long-term investors.

Competition is still fierce for properties and inventory is limited. It’s just not concentrated at the low end of the market like it used to be. These are all signs that the SW Florida real estate market has recovered and on solid ground now.

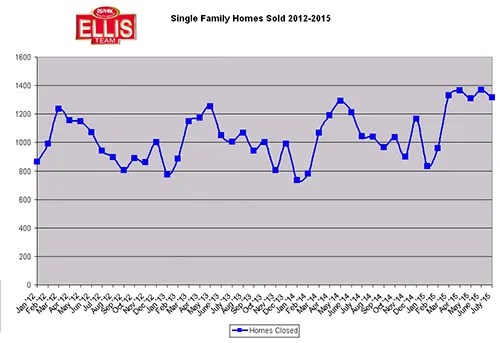

In fact, median days on market is down to 34 days in September, a 10.5% drop since last year. If you look at the graph, drops of 20% or more have been common this year versus last year.

We have a rising market in prices and because more deals are financed it presents a new set of challenges. Appraisals are commonly an issue in rising markets, and with low inventory sometimes there aren’t comparable sales in the same neighborhood to compare against.

We have a rising market in prices and because more deals are financed it presents a new set of challenges. Appraisals are commonly an issue in rising markets, and with low inventory sometimes there aren’t comparable sales in the same neighborhood to compare against.

Also, in a rising market, each new sale stands the chance to set the bar higher, and yet appraisers struggle with how to account for this. Appraisers are excellent at looking in the rear view mirror to substantiate prices. The problem is, the rear view mirror helps explain where the market has been, but does little to justify where it is and where it’s going.

When the market was headed south, appraisers were quick to use a time value adjustment because prices were falling. We believe they need to use this on the way up as well, and some do.

We’ve also seen an increase again in out of town appraisers. We’ve fought this before. One tactic agents would use would be simply to decline to make the home accessible when an out of town appraiser called. You could hardly blame the Realtor for slow-playing access because more appraisals were screwed up by appraisers who were not from here and did not know the market.

If an appraiser failed to do the appraisal in a timely manner, it would be assigned to another appraiser, hopefully one in town. There is a rule that appraisers should be familiar with the market but it doesn’t always bear out. We’re not blaming appraisers. We still blame the Dodd-Frank Act and many of its stupid rules. Dodd Frank needs to be repealed and more practical rules put into place.

Hiring an experienced Realtor to work with you when buying or selling is essential. It’s a beautiful thing when experienced Realtors work together to make a smooth transaction for their clients. We love working with other agents who know what they’re doing. The consumer rarely knows if their agent is good, but they find out later when things go bad.

Make sure you ask probing questions when selecting an agent. Are they full-time? How do they handle such things as code violations, permitting, defective drywall, septic systems, and inspection and repair items? Do they have a list of contractors they can recommend? How many homes have they sold in the last 5 years? The answers to these questions may help you decide if your agent knows how to get you out of trouble before you even get in it.

The market is up. Listings are hard to find but new ones are coming online everyday at www.LeeCountyOnline.com The database is updated every 5 minutes from MLS.

You can reach us at 239-489-4042 if you’d like to buy or sell in SW Florida. Good luck and Happy House Hunting!

November 2015 Future of Real Estate market Update

View our Latest Cape Coral waterfront Listing

View This Cape Coral Waterfront home on Instagtram

River views with pool-Featured Property of the week.

Follow us on Facebook Follow us on Twitter Follow us on Google+